Who Receives Health Care Services in the Netherlands?

The Netherlands boasts a universal healthcare system, ensuring that everyone residing in the country has access to affordable and high-quality medical care. But who exactly benefits from this system? Let’s delve into the details of how healthcare coverage is structured in the Netherlands.

Understanding the Dutch Healthcare System

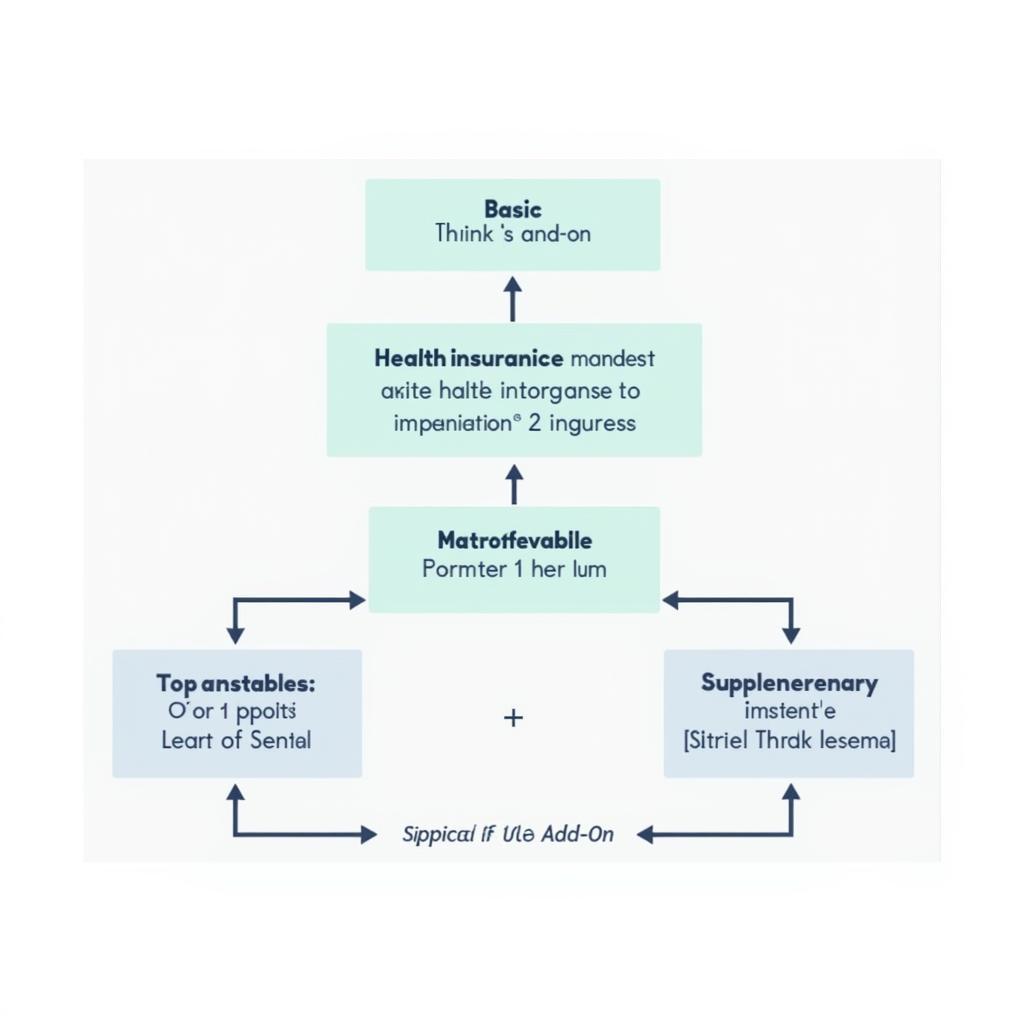

The Dutch healthcare system is based on a dual-layer approach:

- Basic Health Insurance (Basisverzekering): This mandatory insurance plan covers essential medical expenses for all residents, regardless of their income, employment status, or pre-existing conditions.

- Supplementary Health Insurance (Aanvullende verzekering): This optional insurance offers coverage for additional medical services such as dental care, physiotherapy, and alternative medicine. Individuals can choose to purchase this coverage based on their specific needs and budget.

Structure of the Dutch healthcare system

Structure of the Dutch healthcare system

Who is Eligible for Health Care in the Netherlands?

Every legal resident of the Netherlands, including Dutch citizens, permanent residents, and individuals with valid residence permits, is entitled to health care services. This means:

- Citizens: All Dutch citizens, whether residing within the Netherlands or abroad, have access to health care.

- Permanent Residents: Individuals who hold permanent residency in the Netherlands are automatically covered under the healthcare system.

- Temporary Residents: People residing in the Netherlands on temporary visas, such as work or student visas, are also required to have health insurance coverage for the duration of their stay.

Key Features of the Dutch Health Care System

The Dutch health care system is characterized by several key features:

- Mandatory Basic Insurance: Everyone residing in the Netherlands is legally obligated to obtain basic health insurance.

- Income-Based Contributions: Health insurance premiums for the basic plan are income-related, ensuring affordability for individuals across different income brackets.

- Choice of Insurers: Residents have the freedom to choose their preferred health insurance provider from a range of private insurance companies.

- Government Regulation: The Dutch government plays a significant role in regulating the healthcare system, setting premium limits and ensuring quality standards.

Navigating Health Care as an Expat

If you’re an expat moving to the Netherlands, understanding the healthcare system is crucial. Here are some key points to note:

- Register with a Municipality: Upon arrival, you need to register with your local municipality (gemeente) to obtain a citizen service number (BSN), a prerequisite for accessing healthcare services.

- Choose a Health Insurance Provider: Once you have your BSN, you can select a health insurance provider and enroll in a basic health insurance plan.

- Consider Supplementary Insurance: Assess your individual healthcare needs and determine if supplementary insurance is necessary for additional coverage.

Conclusion

The Netherlands’ universal healthcare system ensures that all residents have access to necessary medical care. While the mandatory basic insurance covers essential expenses, supplementary insurance provides additional options for enhanced coverage. By understanding the structure and features of the Dutch healthcare system, individuals can make informed decisions about their coverage and access quality healthcare services.

FAQs about Healthcare in the Netherlands

1. Can I use my European Health Insurance Card (EHIC) in the Netherlands?

Yes, if you’re a citizen of a European Economic Area (EEA) country or Switzerland, your EHIC provides access to medically necessary healthcare during temporary stays in the Netherlands.

2. How do I find a general practitioner (GP) in the Netherlands?

You can find a GP in your local area by searching online directories or asking your health insurance provider for a list of affiliated practitioners.

3. Are there waiting times for medical procedures in the Netherlands?

Waiting times for medical procedures can vary depending on the urgency of the treatment and the availability of specialists.

4. What happens in case of a medical emergency?

In case of a medical emergency, dial 112 for immediate assistance.

5. How do I apply for reimbursement for medical expenses?

You can typically submit your medical bills and receipts directly to your health insurance provider for reimbursement.

For any assistance or inquiries related to car diagnostics, feel free to reach out to us via WhatsApp: +1(641)206-8880 or Email: [email protected]. Our dedicated customer support team is available 24/7 to assist you.