Who is the Largest Payer of Long-Term Care Services?

When facing the need for long-term care, a common concern is affordability. Many individuals wonder, “Who Is The Largest Payer Of Long-term Care Services?” Understanding the answer to this question can be crucial for planning your future care needs.

While private insurance and personal funds play a significant role, the largest payer of long-term care services in the United States is Medicaid.

Understanding Medicaid’s Role in Long-Term Care

Medicaid, a joint federal and state program, provides health coverage to millions of Americans, including eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. A significant portion of Medicaid spending goes towards long-term care services, which encompass a wide range of assistance for individuals needing help with daily activities.

Types of Long-Term Care Services Covered by Medicaid

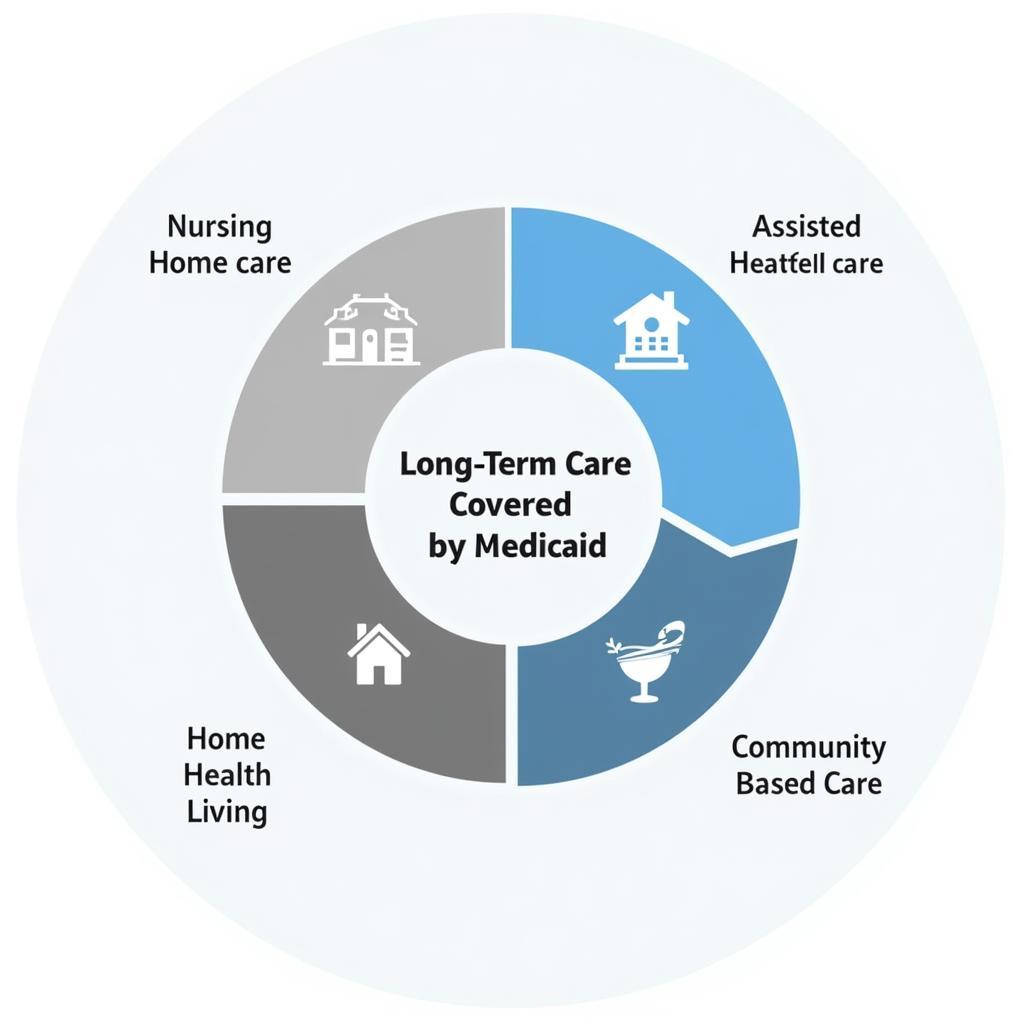

Medicaid coverage for long-term care varies by state, but generally includes:

- Nursing Home Care: Provides 24/7 skilled medical care and assistance with daily living activities in a nursing home setting.

- Assisted Living: Offers housing, support services, and personal care for individuals who need help with daily tasks but don’t require the intensive medical care of a nursing home.

- Home Health Care: Provides medical care and assistance with daily living activities for individuals in their own homes.

- Community-Based Services: Includes adult day care centers, respite care, and personal care services designed to support individuals living at home.

Breakdown of Long-Term Care Services Covered by Medicaid

Breakdown of Long-Term Care Services Covered by Medicaid

Eligibility for Medicaid Long-Term Care Coverage

Medicaid eligibility for long-term care is based on financial need and medical necessity. Eligibility requirements vary by state, but generally include:

- Income Limits: Applicants must have income below a certain threshold, which can vary depending on the type of care needed and the state’s guidelines.

- Asset Limits: Applicants must have limited assets, including savings, investments, and property.

- Functional Limitations: Applicants must demonstrate a need for assistance with daily living activities due to a physical, cognitive, or mental impairment.

How to Apply for Medicaid Long-Term Care

If you or a loved one needs long-term care and you believe you may qualify for Medicaid, you can apply through your state’s Medicaid agency. The application process and specific requirements will vary by state.

The Importance of Planning for Long-Term Care

Long-term care needs can arise unexpectedly and can be financially burdensome. Understanding the role of Medicaid and other funding options is essential for planning for your future care or that of a loved one.

While Medicaid serves as a safety net for many, it’s important to consider other avenues like long-term care insurance or personal savings to help cover potential costs and maintain greater control over your care options.

This article provides a general overview and should not be considered financial or legal advice. Consult with a qualified professional for guidance tailored to your specific circumstances.