Which Statement Characterizes Payment for Home Care and Hospice Services?

Understanding how home care and hospice services are paid for can be confusing. This article aims to clarify which statement characterizes payment for these essential services, breaking down the different payment options available and helping you navigate the complexities of healthcare financing.

Understanding the Payment Landscape for Home Care and Hospice

Home care and hospice services offer vital support to individuals facing various health challenges, allowing them to receive care in the comfort of their own homes. However, the financial aspects of these services can often be a source of concern. Numerous factors influence payment, including the type of service required, the patient’s insurance coverage, and eligibility for government programs.

Medicare and Home Health Care

Medicare plays a significant role in funding home health care services. However, specific criteria must be met for Medicare coverage to apply. The patient must be considered homebound, requiring skilled nursing care or therapy services, and the services must be ordered by a physician. These services are typically covered under Medicare Part A (hospital insurance) and Part B (medical insurance).

Medicaid and Home Care Services

Medicaid, a joint federal and state program, offers another avenue for financing home care. Medicaid eligibility varies by state, but generally covers individuals with limited income and resources. The specific services covered under Medicaid can also differ, so it’s crucial to understand your state’s specific Medicaid guidelines.

Private Insurance and Home Care

Many private insurance plans offer coverage for home care services. The extent of coverage depends on the specific policy. Some plans might cover a limited number of visits, while others may offer more comprehensive coverage. Reviewing your insurance policy carefully is essential to understand what services are covered and any associated co-pays or deductibles.

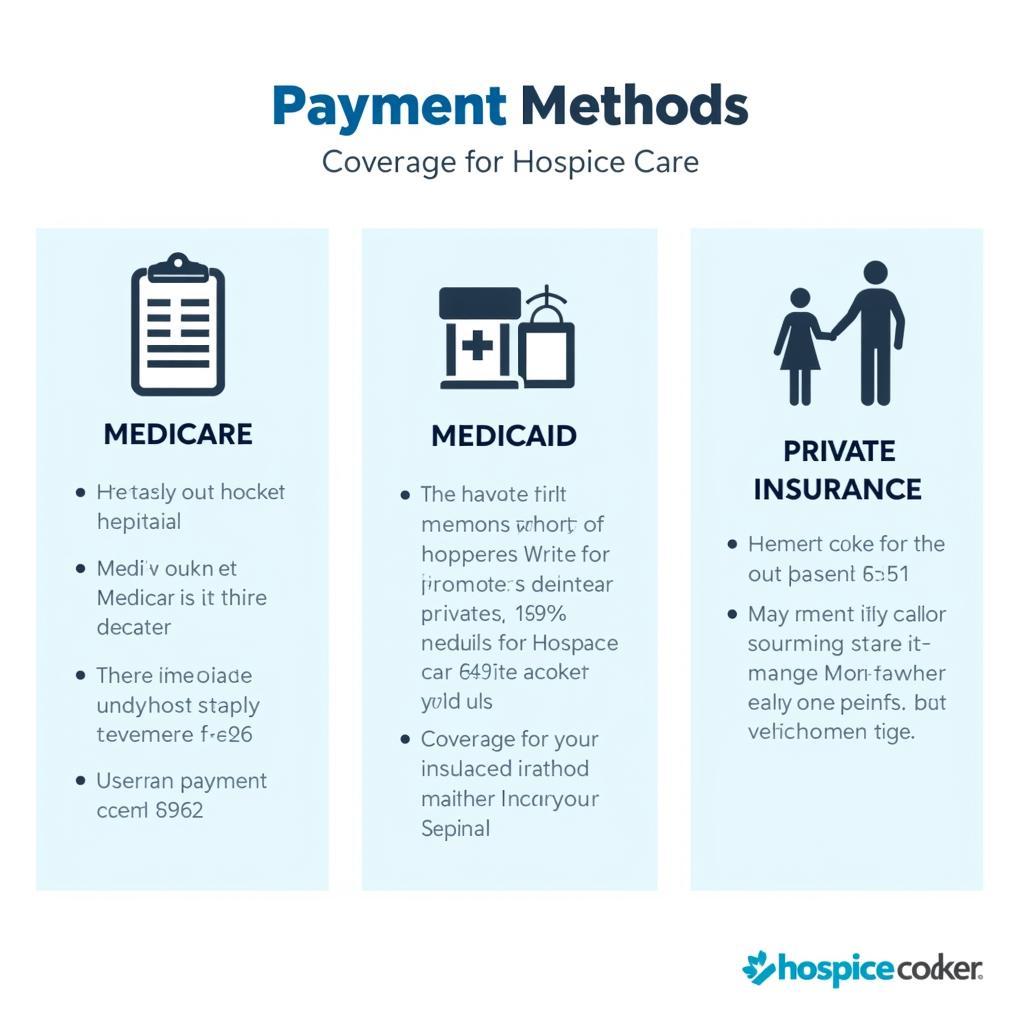

Hospice Care Payment Options

Hospice care focuses on providing comfort and support to individuals nearing the end of life. Medicare, Medicaid, and most private insurance plans offer coverage for hospice services. Similar to home health care, specific criteria must be met for coverage to apply. Generally, a physician must certify that the patient has a life expectancy of six months or less if the illness runs its normal course.

Hospice Care Payment Methods Chart

Hospice Care Payment Methods Chart

Out-of-Pocket Expenses for Home Care and Hospice

While insurance and government programs can cover a significant portion of the costs, some out-of-pocket expenses may still apply. These can include co-pays, deductibles, and services not covered by insurance. It’s important to discuss potential out-of-pocket costs with your healthcare provider and insurance company to plan accordingly.

Long-Term Care Insurance

Long-term care insurance can help cover the costs of extended home care services. These policies are designed to provide financial assistance for individuals needing long-term care due to chronic illness or disability. Purchasing a long-term care insurance policy can be a valuable investment, especially for individuals concerned about the potential financial burden of long-term care.

Long-Term Care Insurance Benefits Explained

Long-Term Care Insurance Benefits Explained

Conclusion: Navigating the Payment System

Navigating the payment system for home care and hospice services requires careful consideration of various factors. Understanding the different payment options available, including Medicare, Medicaid, private insurance, and long-term care insurance, is crucial. By exploring these options and planning accordingly, individuals can ensure access to the necessary care and support while managing the associated financial responsibilities. Which Statement Characterizes Payment For Home Care And Hospice Services? It depends on individual circumstances, but options include Medicare, Medicaid, private insurance, and long-term care insurance.

FAQ

- What are the eligibility requirements for Medicare home health care?

- How does Medicaid coverage for home care vary by state?

- What should I look for in my private insurance policy regarding home care coverage?

- What are the criteria for hospice care coverage under Medicare?

- What are some examples of out-of-pocket expenses for home care and hospice?

- How can long-term care insurance help with home care costs?

- What resources are available to help me understand home care and hospice payment options?

Common Scenarios and Questions

Scenario: An elderly parent needs help with daily activities after a hospital stay.

Question: Will Medicare cover home health care if my parent is unable to leave the house without assistance?

Scenario: A loved one has a terminal illness and wants to remain at home.

Question: How can we arrange for hospice care and what are the payment options?

Further Exploration

For more information on related topics, you might find these articles helpful:

- Understanding Medicare Benefits for Seniors

- Navigating the Medicaid Application Process

- Choosing the Right Long-Term Care Insurance Policy

Need further assistance? Contact us via WhatsApp: +1(641)206-8880, or Email: [email protected]. Our 24/7 customer support team is ready to help.