What is the Government Servicing Tax on Car Rentals?

When you rent a car, you’re often met with various fees and taxes that add to the overall cost. One such charge you might see is the Government Servicing Tax (GST). But what exactly is this tax, and how does it affect your car rental bill?

This comprehensive guide will break down everything you need to know about the government servicing tax on car rentals, helping you understand your expenses better.

Understanding Government Servicing Tax (GST)

In many countries, GST is a value-added tax levied on most goods and services. It’s a consumption tax, meaning the end-user ultimately bears the cost. When applied to car rentals, GST is typically calculated as a percentage of the base rental rate and additional services.

GST Charge on Car Rental Invoice

GST Charge on Car Rental Invoice

How Does GST on Car Rentals Work?

The exact percentage of GST charged on car rentals can vary depending on your location. It’s essential to familiarize yourself with the GST rates applicable in the area where you are renting the vehicle.

For instance:

- Country A might have a standard GST rate of 10%, meaning you’ll pay an additional 10% of your base rental rate as tax.

- Country B could have a different GST rate, say 5%, impacting the final cost accordingly.

Factors Affecting GST on Car Rentals

Several factors can influence the GST amount you’ll pay on your car rental. These include:

- Rental Duration: Generally, longer rentals incur a higher GST amount as the tax is calculated on the total rental cost.

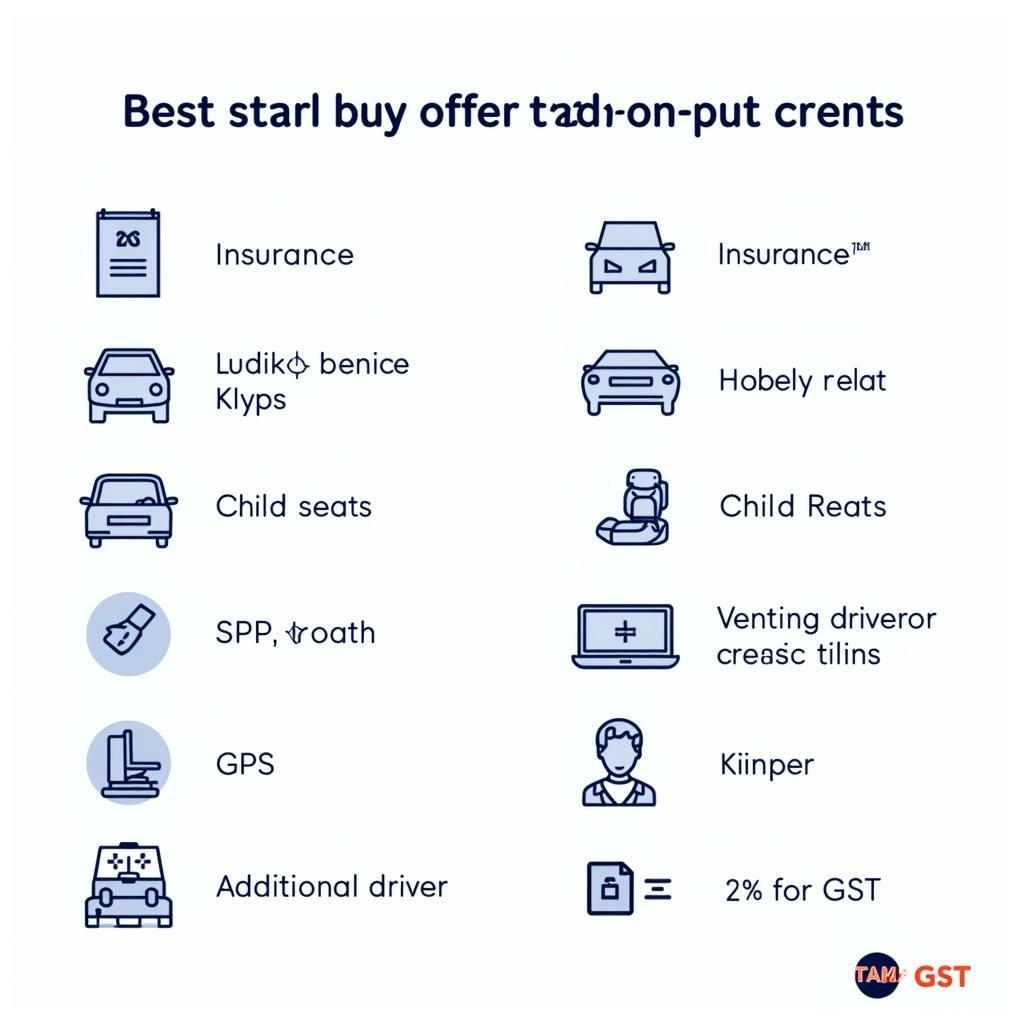

- Additional Services: Opting for extras like insurance, GPS navigation, or child seats can attract GST, further increasing your overall expenses.

- Location: GST rates can vary significantly between states, provinces, or even cities within a country.

Additional Services Impacting GST on Car Rental

Additional Services Impacting GST on Car Rental

Tips for Managing GST on Car Rentals

While you can’t entirely avoid paying GST on your car rental, here are some savvy tips to help manage this expense:

- Inquire About GST Inclusivity: When comparing car rental prices online or through different companies, always check whether the quoted price includes GST. This will help you avoid unexpected surprises and make informed decisions.

- Factor in GST During Budget Planning: Before finalizing your car rental, factor in the potential GST amount to ensure it aligns with your travel budget.

- Consider Rental Duration: If you’re on a tight budget, opting for a slightly shorter rental period might help reduce the overall GST you’ll pay.

Conclusion

Understanding the government servicing tax on car rentals is crucial for making informed decisions and avoiding unexpected costs. By knowing how GST is calculated and the factors that can influence its amount, you can better manage your car rental expenses and enjoy a smoother travel experience. Remember to inquire about GST inclusivity when comparing prices and factor this tax into your budget to avoid surprises.

FAQs about GST on Car Rentals

1. Is GST on car rentals refundable?

Generally, GST paid on car rentals is non-refundable for personal use. However, business rentals might be eligible for GST reclaims depending on local tax regulations.

2. How can I calculate the GST on my car rental?

To calculate GST, multiply the base rental rate by the applicable GST percentage in your rental location.

3. Are there any exemptions from paying GST on car rentals?

GST exemptions on car rentals are rare and typically apply to specific organizations or circumstances, such as diplomatic missions or charitable organizations.

4. Do all car rental companies charge GST?

Yes, all legitimate car rental companies are required to collect and remit GST as mandated by the government.

5. Can I get a discount on GST for car rentals?

GST rates are generally fixed and not subject to discounts or negotiations.

Need further assistance? Our expert team is available 24/7 to answer your queries. Contact us via WhatsApp: +1(641)206-8880, or Email: [email protected].