What Are Service Charges in Car Insurance?

When you’re shopping for car insurance, it’s easy to get bogged down in the jargon. One term you might come across is “service charge.” Understanding what service charges are and how they work can save you money and frustration in the long run.

This comprehensive guide will break down everything you need to know about service charges in car insurance. We’ll cover what they are, why they exist, and how they might impact your insurance premiums.

Unpacking the Term: What Exactly Are Service Charges?

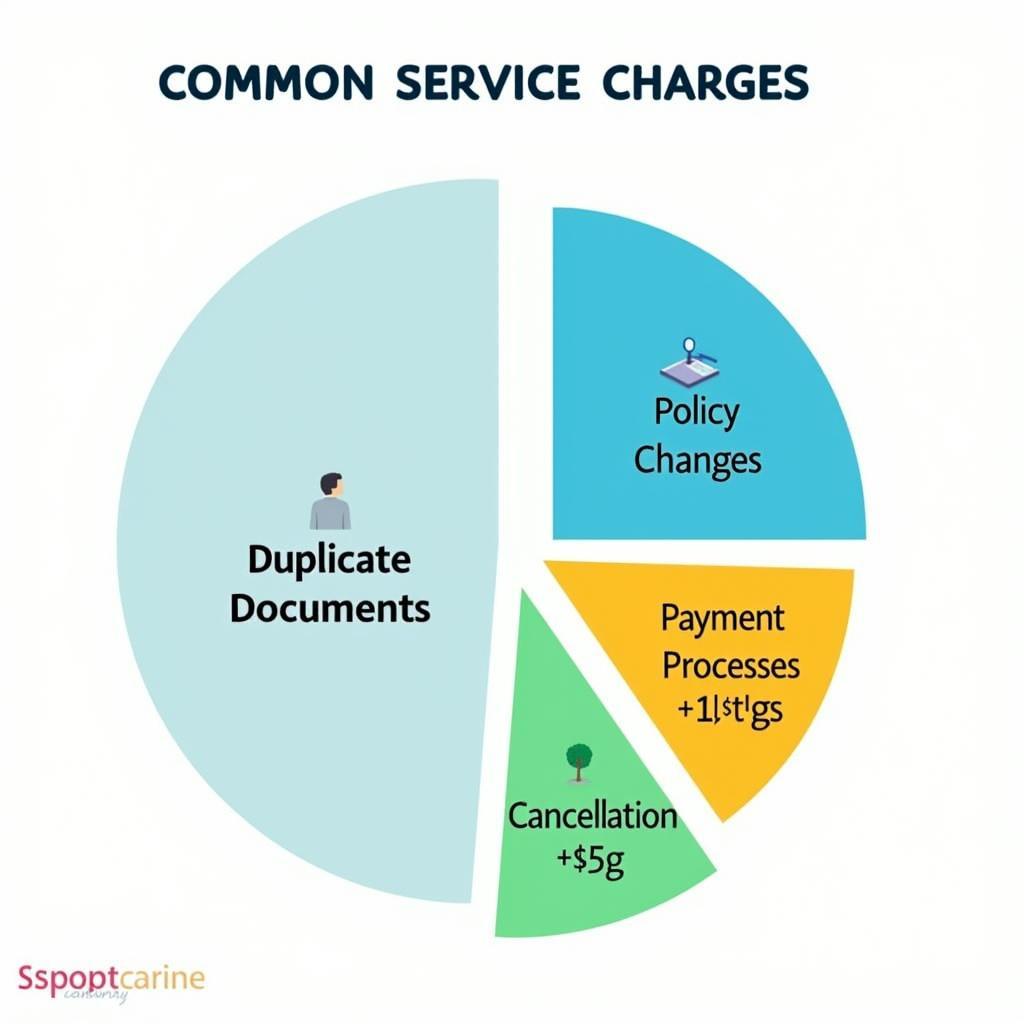

In the simplest terms, service charges in car insurance are fees charged by your insurance provider for specific services rendered. These charges are separate from your regular premium payments and are typically associated with tasks like:

- Policy Changes: Need to update your address, add a new driver, or modify your coverage? These changes often come with a service charge.

- Duplicate Documents: Lost your insurance card or need an extra copy of your policy? Expect a service charge for reprints.

- Payment Processing: Some insurers may charge a fee for processing payments made over the phone or in person.

- Cancellation Fees: If you decide to cancel your policy before its expiration date, you may be subject to a cancellation fee.

It’s essential to remember that not all car insurance companies charge for these services. However, it’s becoming increasingly common, making it crucial to compare quotes and policy terms carefully.

Car Insurance Service Charge Breakdown

Car Insurance Service Charge Breakdown

Why Do Car Insurance Companies Have Service Charges?

While it might seem like an added expense, there are a few reasons why service charges have become standard practice for many car insurance providers:

- Administrative Costs: Processing changes, issuing documents, and handling payments all involve administrative work. Service charges help offset these costs.

- Technology and Infrastructure: Insurance companies invest heavily in technology and systems to manage policies and process transactions. Service charges contribute to maintaining and upgrading these systems.

- Deterrent for Frequent Changes: By implementing service charges, insurers discourage policyholders from making frequent, minor changes that can be administratively burdensome.

How to Minimize Service Charges on Your Car Insurance

The good news is that you can often avoid or reduce service charges by taking a proactive approach:

- Read the Fine Print: Before signing up for a policy, thoroughly review the terms and conditions related to service charges.

- Online Account Management: Many insurers offer online portals where you can make certain changes to your policy, request documents, and manage payments without incurring fees.

- Bundling Services: If you need to make multiple changes, inquire about bundling them together to see if you qualify for a reduced overall service charge.

- Negotiate: Don’t be afraid to negotiate with your insurance provider. Sometimes, they may be willing to waive or lower service charges, especially for loyal customers.

Comparing Car Insurance Quotes

Comparing Car Insurance Quotes

Navigating the World of Car Insurance Service Charges

Understanding the nuances of service charges can empower you to make informed decisions about your car insurance. Remember, while service charges are common, the specific fees and policies can vary significantly between providers.

Don’t hesitate to ask your insurance agent or company representative for clarification on any charges you don’t understand. By being informed and proactive, you can minimize unnecessary expenses and ensure you’re getting the best possible value for your car insurance.

Need more car-related insights? Explore our other informative articles:

- Which car recovery service: Find the right recovery service that suits your needs and budget.

- How much to own a self-service car wash: Discover the financial aspects of running your own car wash business.

We’re here to support you with all your car service needs! Contact our 24/7 customer support team via WhatsApp: +1(641)206-8880 or Email: [email protected].