Is Assisted Living Care a Specified Service Business?

Is assisted living care a specified service business? This is a crucial question for many individuals considering assisted living for themselves or loved ones, and also for those involved in providing these services. Understanding the classification of assisted living as a specified service business can have significant tax implications and impact financial planning. This article will delve into the complexities surrounding this classification, examining the various factors that determine whether assisted living qualifies as a specified service business and what that means for those involved.

Understanding Specified Service Businesses

A specified service business (SSB) is a designation within the US tax code that affects how certain businesses calculate their qualified business income (QBI) deduction. This deduction, introduced under the Tax Cuts and Jobs Act of 2017, allows eligible taxpayers to deduct up to 20% of their qualified business income. However, for SSBs, the QBI deduction can be limited or phased out depending on the taxpayer’s taxable income. The classification of a business as an SSB depends on the type of services provided.

Does Assisted Living Qualify as a Specified Service Business?

The core question of whether assisted living is considered an SSB isn’t straightforward. The IRS doesn’t explicitly categorize assisted living as an SSB. Instead, the determination hinges on the specific services provided by the facility. Generally, services in the fields of health, law, accounting, performing arts, and athletics are considered specified services. Within assisted living, factors such as the level of medical care provided can influence the classification.

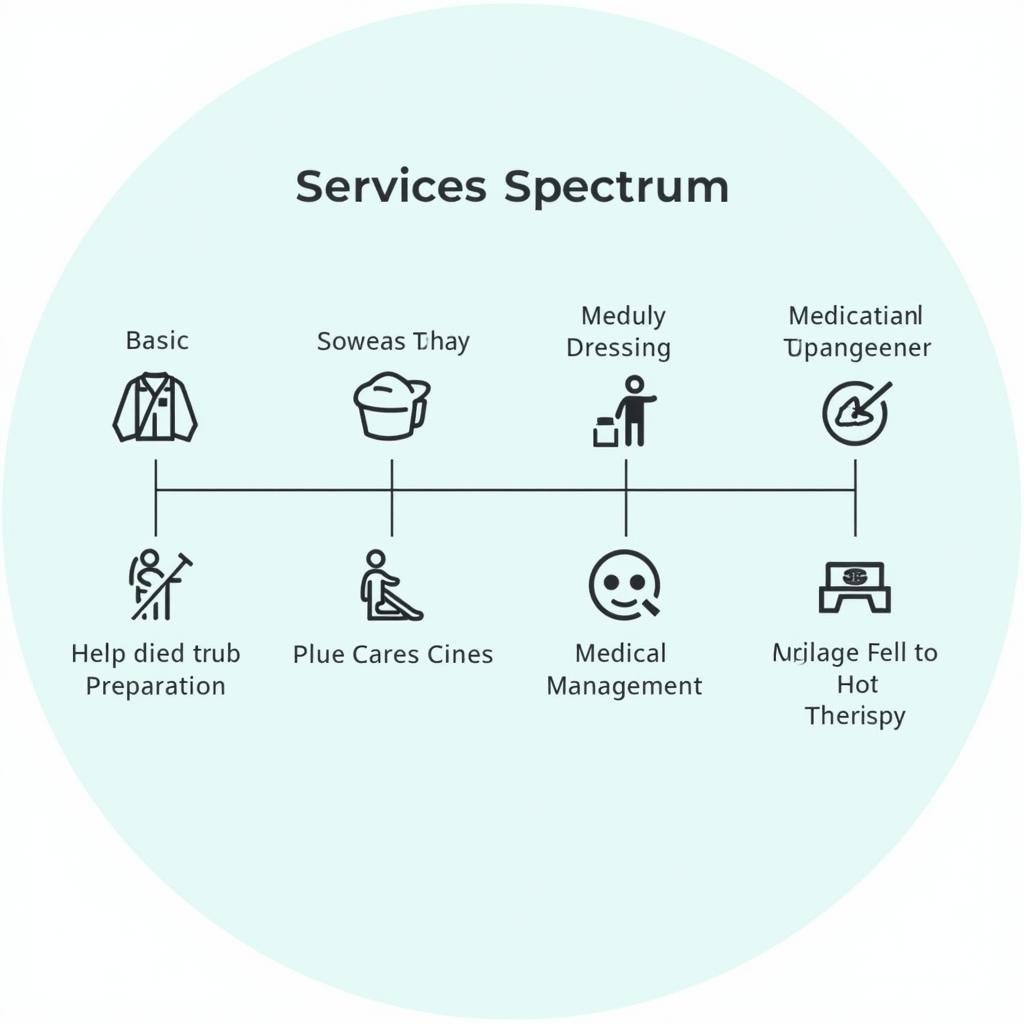

If a facility primarily provides custodial care – assistance with daily living activities like bathing, dressing, and eating – it’s less likely to be classified as an SSB. However, if the facility offers substantial medical services, such as medication management, skilled nursing care, or physical therapy, it could be viewed as an SSB. The more extensive the medical services offered, the greater the likelihood of being categorized as an SSB.

Assisted Living Services Spectrum

Assisted Living Services Spectrum

Implications of the SSB Classification for Assisted Living

The SSB designation impacts both the assisted living facility and the individuals receiving care. For the facility, being classified as an SSB can affect its taxable income and the availability of the QBI deduction. This, in turn, can influence profitability and investment decisions. For residents and their families, understanding the SSB classification can be crucial for financial planning. The costs of assisted living may be deductible as medical expenses, but these deductions are subject to certain limitations based on adjusted gross income.

Navigating the Complexities of SSB Classification

Given the nuances of the SSB determination, it’s essential for assisted living facilities and individuals to seek professional advice. Consulting with a tax advisor or certified public accountant (CPA) can provide clarity on the specific circumstances and ensure compliance with tax regulations. They can analyze the services provided by the facility and determine the appropriate classification.

What are the key factors determining SSB classification?

The primary factor is the nature of the services provided. Medical services are more likely to trigger SSB classification than custodial care services.

How can assisted living facilities manage the impact of SSB classification?

Careful financial planning and consultation with tax professionals are vital. Facilities can explore strategies to optimize their tax position while continuing to provide quality care.

What should families consider regarding SSB and assisted living?

Families should understand the potential tax implications of the SSB classification and incorporate this into their overall financial planning for assisted living expenses.

“Understanding the tax implications of assisted living is crucial for both providers and recipients of care. A clear understanding of the SSB classification can help ensure informed financial decisions,” says John Smith, CPA, Senior Tax Partner at XYZ Accounting Firm.

Assisted Living Tax Planning

Assisted Living Tax Planning

Conclusion

The question “is assisted living care a specified service business?” requires careful consideration of the specific services offered. While assisted living isn’t automatically categorized as an SSB, the level of medical care provided can significantly influence the determination. Understanding this classification is crucial for both assisted living facilities and the individuals they serve, allowing for informed financial planning and compliance with tax regulations. Consulting with a qualified tax professional is highly recommended to navigate the complexities of this classification and its implications.

FAQ

- What is a specified service business?

- How does the SSB classification affect the QBI deduction?

- What types of services are considered specified services?

- How can I determine if an assisted living facility is an SSB?

- What are the tax implications of assisted living expenses?

- Where can I find more information about SSB classification?

- What are the benefits of consulting with a tax professional regarding assisted living?

For further assistance, please contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit our office at 456 Oak Avenue, Miami, FL 33101, USA. Our customer service team is available 24/7.