How to Valuate a Self Service Car Wash

Valuating a self-service car wash involves a comprehensive assessment of various factors, from tangible assets to market conditions. This guide provides a detailed approach to determining the true worth of your car wash business. Whether you’re looking to sell, secure financing, or simply understand your business’s financial health, knowing how to valuate a self-service car wash is crucial. Let’s delve into the key aspects that contribute to a precise valuation. Interested in electric car charging? Learn more about how many amp service for electric car.

Key Factors in Valuating a Self-Service Car Wash

Several key factors play a crucial role in determining the value of a self-service car wash. Understanding these elements is essential for an accurate valuation.

Financial Performance

- Revenue and Expenses: A thorough analysis of historical financial statements, including income statements and cash flow statements, is paramount. This provides insights into profitability and sustainability.

- Profitability Margins: Calculate key profitability ratios like gross profit margin and net profit margin to assess the efficiency of operations.

- Cash Flow: Consistent and positive cash flow is a strong indicator of a healthy business and contributes significantly to its value.

Assets and Liabilities

- Real Estate: The value of the land and any buildings on the property is a significant component of the overall valuation.

- Equipment: Assess the condition and age of the car wash equipment, including bays, vacuums, and other related machinery.

- Liabilities: Outstanding loans, leases, and other financial obligations impact the net value of the business.

Market Analysis

- Location: A prime location with high traffic and visibility significantly increases the value of a self-service car wash.

- Competition: The number and proximity of competitors can influence pricing strategies and market share, impacting overall value.

- Market Growth Potential: Understanding the local market’s demographics and growth projections can indicate future revenue potential. Understanding what’s included in a standard car service can help you gauge market offerings – see what is included in a standard car service.

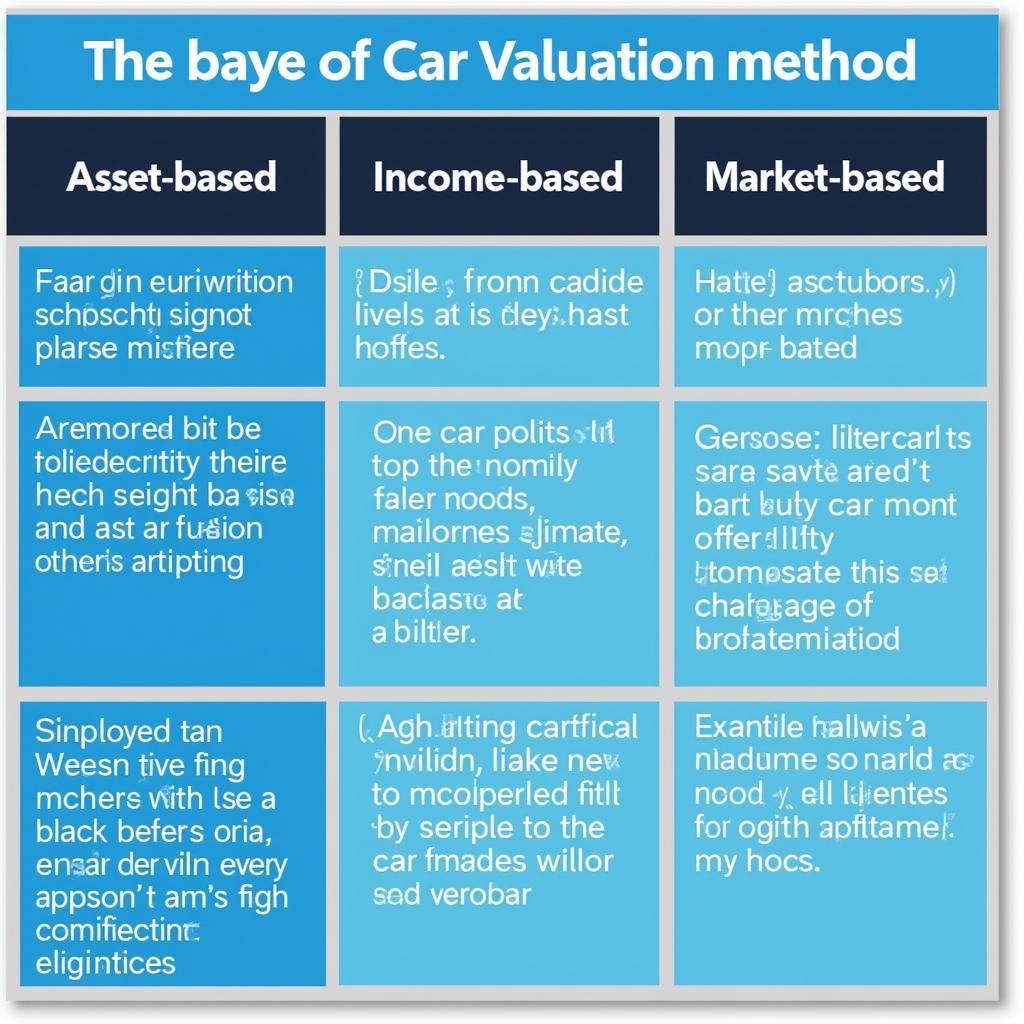

Valuation Methods

There are several approaches to valuing a self-service car wash. Each method has its own strengths and weaknesses, and choosing the right one depends on the specific circumstances.

Asset-Based Valuation

This method focuses on the net asset value of the business, calculated by subtracting liabilities from the value of assets. It provides a baseline value but may not fully capture the earning potential.

Income-Based Valuation

This approach uses the business’s projected future income to determine its present value. Methods like discounted cash flow analysis are commonly used. This method is particularly relevant for businesses with strong and predictable cash flows. You might be interested in exploring which car brand offers more services to understand market competition.

Market-Based Valuation

This method compares the car wash to similar businesses that have recently been sold. It relies on finding comparable sales data, which can be challenging in some markets. However, it provides a realistic market-driven valuation.

Different Valuation Methods for Car Washes

Different Valuation Methods for Car Washes

Due Diligence and Professional Advice

Conducting thorough due diligence is essential. This includes verifying financial records, inspecting equipment, and assessing environmental compliance. Seeking professional advice from appraisers, accountants, and legal counsel is highly recommended for a comprehensive and accurate valuation. Knowing what is in a full service for a car can inform your understanding of service offerings and potential revenue streams.

“Accurate valuation is crucial for making informed business decisions. Don’t underestimate the importance of professional guidance in this process.” – John Smith, Certified Business Appraiser

Conclusion

How to valuate a self-service car wash requires a multifaceted approach, considering financial performance, assets, market conditions, and appropriate valuation methods. A thorough and accurate valuation is crucial for informed decision-making, whether you’re buying, selling, or seeking financing. Remember, professional advice is invaluable in this process.

FAQ

- What is the most common valuation method for car washes? Income-based valuation is often preferred, particularly for established businesses.

- How often should I re-evaluate my car wash’s value? It’s generally recommended to re-evaluate every 1-2 years or when significant changes occur in the business or market.

- What are some common mistakes to avoid during valuation? Overlooking key expenses, neglecting market analysis, and not seeking professional advice are common pitfalls.

- Does the type of car wash (self-service, automatic, etc.) affect the valuation process? Yes, each type of car wash has unique characteristics that influence the valuation approach.

- How can I increase the value of my car wash? Improving customer service, upgrading equipment, and expanding services can enhance profitability and value. Understanding what does servicing car mean can broaden your perspective on service offerings.

- How do I find comparable sales data for a market-based valuation? Business brokers, industry publications, and online databases can be helpful resources.

- What are some key performance indicators (KPIs) to track for my car wash? Revenue per car, customer acquisition cost, and customer retention rate are important KPIs to monitor.

Seeking Professional Advice for Car Wash Valuation

Seeking Professional Advice for Car Wash Valuation

Need help with your car service? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 456 Oak Avenue, Miami, FL 33101, USA. Our customer service team is available 24/7.