How to Pay for Home Care Services: A Comprehensive Guide

Navigating the financial aspect of home care services can often feel overwhelming. Understanding your payment options and available resources is crucial to make informed decisions and ensure your loved ones receive the best possible care. This guide explores various methods for paying for home care services, providing clarity and empowering you to choose the best path for your unique situation.

Unveiling the Costs: Factors Influencing Home Care Expenses

The cost of home care services varies greatly depending on several factors:

- Type and Frequency of Care: Are you seeking assistance with daily living activities like bathing and dressing, or do you require skilled medical care? The intensity and duration of care significantly impact the overall cost.

- Geographic Location: Home care costs fluctuate based on your location’s cost of living and demand for services. Urban areas might experience higher prices compared to rural settings.

- Provider Type: Choosing between an agency, registry, or independent caregiver influences costs. Agencies typically have higher rates due to administrative fees, while independent caregivers might offer more flexibility in payment arrangements.

Exploring Your Payment Options: A Breakdown of Possibilities

Let’s delve into the various avenues available for financing home care:

1. Private Pay: Utilizing Personal Funds

Many individuals opt to pay for home care out of pocket, utilizing personal savings, investments, or retirement funds. This direct approach offers flexibility and control over care arrangements.

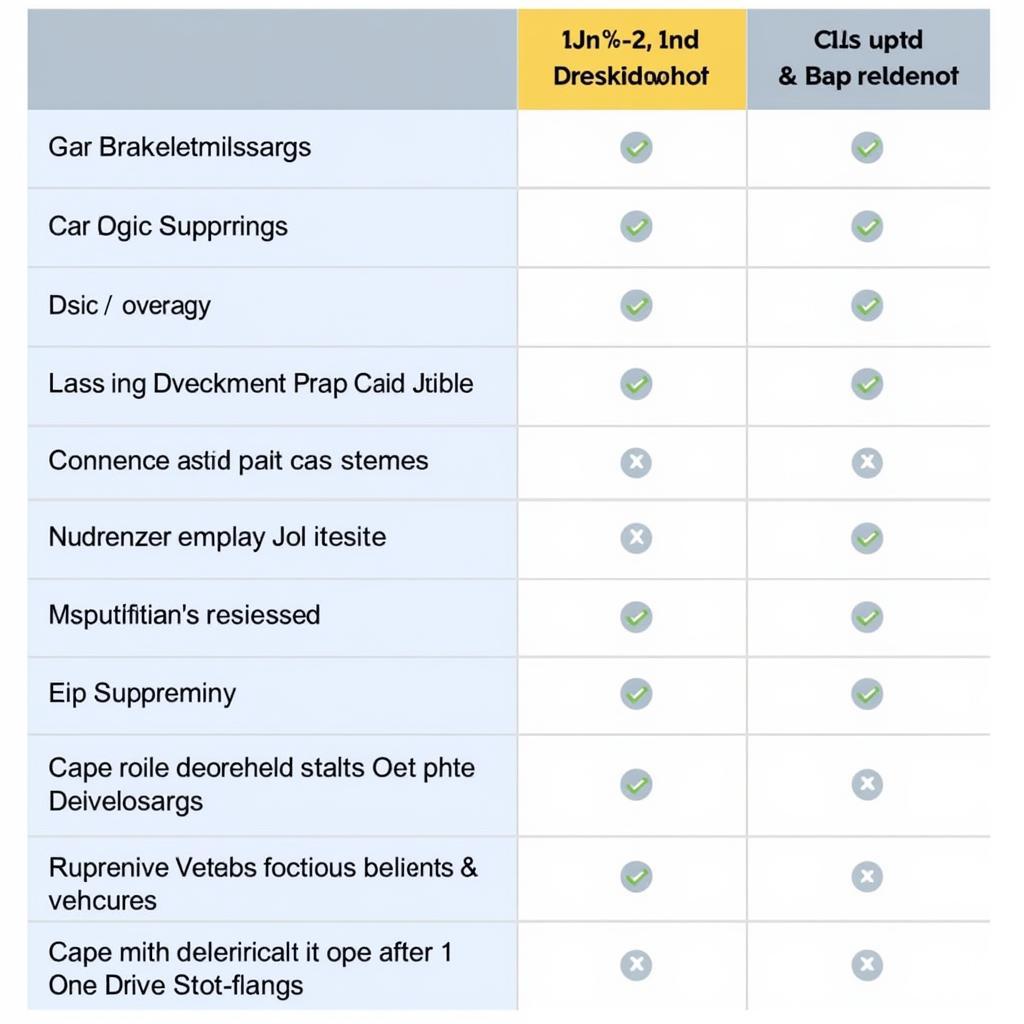

2. Long-Term Care Insurance: Leveraging Financial Protection

Long-term care insurance can be a valuable asset, covering a portion or all home care expenses. It’s crucial to review your policy’s specific coverage and eligibility requirements.

3. Medicare: Understanding Eligibility and Coverage

While Medicare doesn’t cover long-term custodial care, it may provide limited coverage for skilled nursing care or therapy services at home under specific conditions.

4. Medicaid: Navigating Eligibility and Benefits

Medicaid, a joint federal and state program, offers financial assistance for home care services to eligible low-income individuals.

Medicaid Home Care Benefits Explained

Medicaid Home Care Benefits Explained

5. Veterans Benefits: Accessing Support for Veterans

Eligible veterans and their surviving spouses may qualify for home care benefits through the Department of Veterans Affairs (VA). These benefits can offer financial relief and access to specialized care.

6. Reverse Mortgages: Tapping into Home Equity

A reverse mortgage allows homeowners aged 62 or older to convert a portion of their home equity into cash, potentially funding home care expenses. It’s essential to carefully consider the terms and implications of a reverse mortgage before proceeding.

Guide to Reverse Mortgages for Seniors

Guide to Reverse Mortgages for Seniors

Creative Financing Solutions: Exploring Alternative Options

Beyond traditional methods, consider these alternative financing approaches:

- Life Insurance Policies: Some policies offer accelerated death benefits or long-term care riders, providing funds for home care.

- Home Equity Loans and Lines of Credit: Tapping into your home’s equity can provide funds for care, but it’s crucial to assess associated risks and repayment terms.

- Caregiver Agreements: Family members providing care can enter formal agreements outlining compensation, ensuring financial clarity and potential tax advantages.

Essential Tips for Managing Home Care Costs:

- Plan Ahead: Start exploring payment options early on to make informed decisions and explore long-term care insurance if applicable.

- Compare Costs: Request quotes from multiple providers, agencies, or independent caregivers to understand the going rates in your area.

- Negotiate Rates: Don’t hesitate to negotiate rates, especially if opting for private pay or considering long-term arrangements.

- Explore Tax Deductions: Consult a tax professional to determine if you qualify for deductions related to medical expenses, including home care costs.

Conclusion: Empowering Informed Decisions for Quality Care

Paying for home care services requires careful consideration and planning. By understanding your options, exploring available resources, and seeking expert guidance, you can navigate this complex landscape and secure the best possible care for your loved ones. Remember, you’re not alone in this journey – numerous resources and support systems are available to assist you every step of the way.

Need help navigating home care services? Contact our 24/7 support team via WhatsApp: +1(641)206-8880 or Email: [email protected]. We’re here to help you make informed decisions and connect you with the right resources.