How to Calculate Service Charges for Credit Card Payments

Understanding how service charges are calculated for credit card payments is crucial for both businesses and consumers. This article will break down the different components involved in these charges, empowering you to make informed decisions and potentially save money.

Calculating Credit Card Service Charges

Calculating Credit Card Service Charges

Decoding Credit Card Service Charges

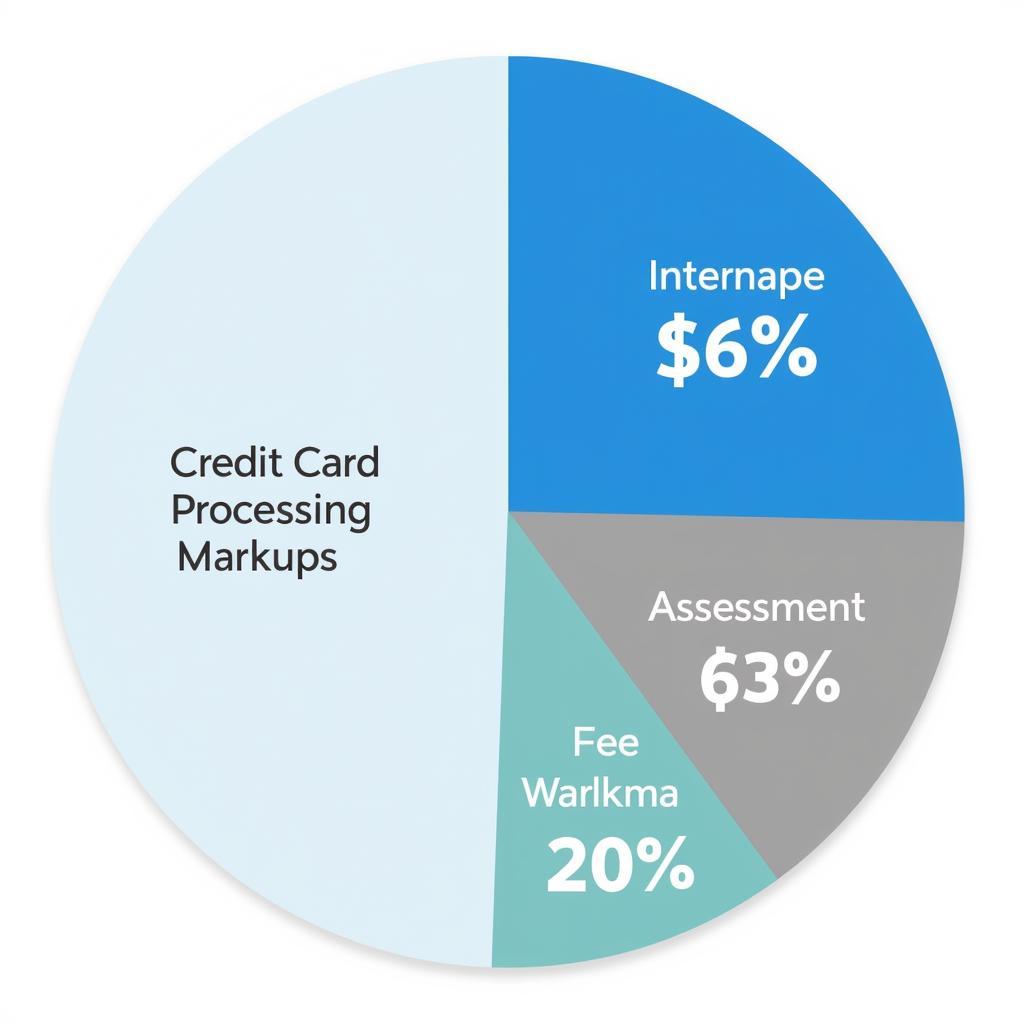

Credit card processing fees aren’t arbitrary. They cover the costs associated with facilitating transactions. These costs include interchange fees, assessment fees, and processor markups. Let’s delve into each of these components.

Interchange Fees: The Core Component

Interchange fees are paid by the merchant to the card-issuing bank. These fees are set by the card networks (Visa, Mastercard, etc.) and vary based on several factors, including the type of card (debit, credit, rewards), the processing method (swiped, keyed in, online), and the merchant category code (MCC).

Assessment Fees: Supporting the Network

Assessment fees are paid by the merchant to the card network itself. These fees are typically a small percentage of the transaction amount and contribute to the network’s operating costs.

Processor Markups: The Service Provider’s Share

Processing companies add their own markup on top of the interchange and assessment fees. This markup is their profit margin and can be a flat fee per transaction or a percentage of the transaction amount. Understanding how these markups are structured is crucial for businesses.

Credit Card Fees Breakdown

Credit Card Fees Breakdown

Calculating the Total Service Charge

The total service charge is the sum of the interchange fee, the assessment fee, and the processor markup. This can be a complex calculation, as the interchange fee varies depending on several factors. Many processors offer different pricing models, such as tiered pricing, interchange-plus pricing, and flat-rate pricing. Each model has its pros and cons, and choosing the right one can significantly impact your bottom line.

Tiered Pricing: Simplicity vs. Transparency

Tiered pricing categorizes transactions into different tiers based on risk and processing complexity. Each tier has a different processing rate. While simple, this model can sometimes lack transparency, making it difficult to determine the exact breakdown of fees.

Interchange-Plus Pricing: Transparency and Predictability

Interchange-plus pricing is more transparent. The merchant pays the interchange fee plus a fixed markup by the processor. This allows for greater predictability and potentially lower costs for businesses with high transaction volumes.

Flat-Rate Pricing: Simplicity for Low-Volume Businesses

Flat-rate pricing charges a fixed percentage for all transactions, regardless of the card type or processing method. This is often the simplest option for small businesses with low transaction volumes.

what does a car service charge from airport to hotel

Negotiating Lower Service Charges

Don’t be afraid to negotiate with your processor. Comparing quotes from different processors can help you secure a better deal. Volume discounts and long-term contracts can also reduce your overall processing costs.

Negotiating Credit Card Processing Fees

Negotiating Credit Card Processing Fees

Conclusion: Mastering Credit Card Service Charges

Understanding how to calculate and manage service charges for credit card payments is essential for both businesses and consumers. By understanding the different components and pricing models, you can make informed decisions that save you money and streamline your finances. By mastering these concepts, you can take control of your credit card processing costs.

Expert Insight:

- John Smith, Financial Consultant at ABC Finance: “Negotiating processing fees is often overlooked, but it can have a significant impact on a business’s profitability.”

- Jane Doe, Payment Processing Specialist at XYZ Solutions: “Choosing the right pricing model depends on your specific business needs and transaction volume. One size doesn’t fit all.”

- David Lee, CEO of Merchant Services Inc.: “Transparency in pricing is paramount. Businesses should know exactly what they’re paying for.”

FAQs:

- What is the average credit card processing fee?

- How can I reduce my credit card processing fees?

- What are the different types of credit card processing fees?

- How do I choose the right credit card processor?

- What is PCI compliance and why is it important?

- What are the benefits of accepting credit cards?

- How do I calculate the effective rate of my credit card processing fees?

Need More Help?

For further assistance, please contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit our office at 456 Oak Avenue, Miami, FL 33101, USA. We offer 24/7 customer support.