When you’re investing in a car, you want to ensure it’s well-maintained and protected from unexpected repair costs. That’s where vehicle service contracts, like EasyCare, come in. But do these plans actually cover the services you need? This article will delve into the details of EasyCare coverage, helping you make informed decisions about protecting your vehicle investment.

What Does EasyCare Cover?

EasyCare offers a range of vehicle service contracts tailored to different needs and budgets. While the specifics can vary based on the plan you choose and your location, some commonly covered components include:

- Engine: Major engine components like the cylinder block, cylinder head, and crankshaft are typically covered.

- Transmission: Coverage usually extends to the transmission case, torque converter, and valve body.

- Drive Axle: Front and rear drive axle components are often included.

- Brakes: Coverage may include components like the master cylinder, calipers, and wheel cylinders.

- Electrical System: This can cover elements like the alternator, starter motor, and power windows.

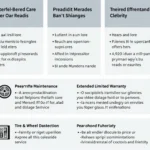

What Services are Typically Excluded?

While EasyCare plans offer comprehensive coverage, it’s important to be aware of potential exclusions. These can vary but often include:

- Regular Maintenance: Routine services like oil changes, tire rotations, and filter replacements are generally not covered.

- Wear and Tear Items: Parts expected to wear down over time, such as brake pads, wiper blades, and tires, are usually excluded.

- Pre-Existing Conditions: Issues present before the contract start date may not be covered.

- Damage from Accidents or Negligence: Coverage usually doesn’t extend to repairs needed due to collisions or improper vehicle maintenance.

Factors Influencing Your Coverage

Several factors can influence the specific services covered by your EasyCare plan:

- Plan Type: EasyCare offers various plans with different levels of coverage. More comprehensive plans come at a higher cost but offer broader protection.

- Vehicle Age and Mileage: Coverage options and costs are often influenced by your vehicle’s age and mileage at the time of purchase.

- Deductible: Choosing a higher deductible can lower your monthly payments but result in higher out-of-pocket expenses when you need repairs.

Understanding Your Contract

Before purchasing an EasyCare plan, carefully review the contract terms and conditions. Pay close attention to:

- Covered Components and Services: Ensure the plan you choose covers the specific components and services you’re most concerned about.

- Exclusions and Limitations: Be aware of any exclusions or limitations that could affect your coverage.

- Deductible and Payment Terms: Understand your deductible amount and payment options.

- Claims Process: Familiarize yourself with the claims process and any required documentation.

Is EasyCare Right for You?

Deciding whether an EasyCare plan is right for you depends on your individual needs and risk tolerance. Consider these factors:

- Your Budget: Evaluate whether the monthly payments and potential deductible fit comfortably within your budget.

- Your Vehicle’s Reliability: If you have a newer, reliable car, you might be less likely to need extensive repairs.

- Your Peace of Mind: For many, the peace of mind that comes with knowing they’re protected from unexpected repair costs outweighs the cost of the plan.

Ultimately, the decision to purchase an EasyCare plan is a personal one. However, by thoroughly researching your options and understanding the terms of the contract, you can make an informed decision that aligns with your needs and budget.