Do Service Members Pay Property Taxes on Cars?

Understanding whether service members pay property taxes on their vehicles is crucial for financial planning and budgeting. This article dives deep into the topic, exploring the nuances of vehicle property taxes for military personnel and providing clarity on the various exemptions and benefits available.

Vehicle Property Taxes: A General Overview

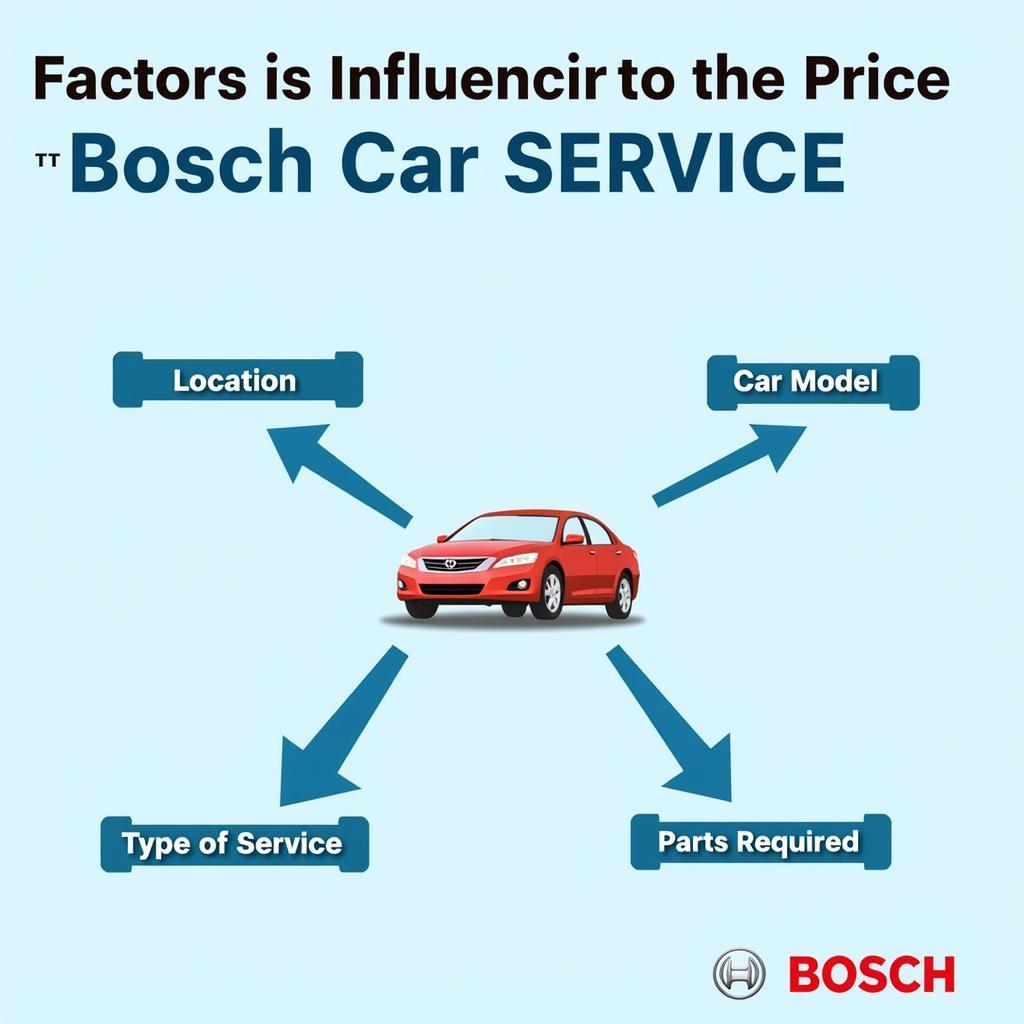

Most states levy an annual property tax on vehicles, often referred to as an excise tax or ad valorem tax. This tax is typically based on the assessed value of the vehicle and varies based on factors like the vehicle’s age, make, and model. The revenue generated from these taxes generally funds local services such as road maintenance and schools. But the rules for military members can be different.

Do Service Members Get a Break on Car Property Taxes?

The short answer is: it depends. While federal law doesn’t explicitly exempt service members from state and local taxes, many states offer specific exemptions or benefits to military personnel regarding vehicle property taxes. These benefits often depend on the service member’s legal residence or domicile, vehicle registration location, and the specific state laws.

Understanding Domicile vs. State of Service

Domicile is a critical concept when discussing tax implications for military members. It refers to a person’s permanent legal residence, the place they intend to return to after their military service. This can be different from the state where they are currently stationed. Many states offer property tax exemptions for vehicles registered in the service member’s state of domicile, even if the vehicle is housed in a different state due to military orders.

Military Family Car Registration Documents

Military Family Car Registration Documents

Exploring State-Specific Exemptions and Benefits

Each state has its own set of rules and regulations regarding vehicle property taxes for military members. Some states offer full exemptions, while others provide partial exemptions or reduced rates. Some common scenarios include:

- Exemption based on Domicile: Several states exempt vehicles registered in the service member’s state of domicile, regardless of where they are stationed.

- Exemption based on Vehicle Location: Some states offer exemptions for vehicles physically located within the state, even if the service member is not a resident.

- Partial Exemptions or Reduced Rates: Some states may offer partial exemptions or reduced tax rates for military members, often based on length of service or other qualifying criteria.

It’s essential for service members to research the specific laws of both their state of domicile and the state where their vehicle is registered to determine their eligibility for any tax benefits.

How to Claim Vehicle Property Tax Exemptions for Military Members

The process for claiming vehicle property tax exemptions varies by state. Generally, it involves providing documentation such as military orders, proof of domicile, and vehicle registration information to the relevant tax authority.

Common Required Documentation

- Military Orders: Official military orders showing the service member’s assignment location.

- Proof of Domicile: Documentation establishing the service member’s legal residence, such as a driver’s license, voter registration card, or utility bills.

- Vehicle Registration: Proof of vehicle registration in the appropriate state.

Military Member Completing Vehicle Property Tax Exemption Forms

Military Member Completing Vehicle Property Tax Exemption Forms

Common Questions About Military Vehicle Property Taxes

Here are some frequently asked questions about vehicle property taxes for service members:

- What if my domicile and state of service are different? You may be eligible for tax exemptions in either state, depending on their respective laws.

- How do I determine my state of domicile? Domicile is generally established by factors such as where you vote, own property, and maintain permanent ties.

- What if I am deployed overseas? Many states offer exemptions for vehicles owned by deployed service members.

Conclusion

Navigating vehicle property tax laws can be complex for service members. Understanding the differences between domicile and state of service, as well as researching state-specific exemptions, is vital for minimizing tax burdens. By carefully reviewing the relevant regulations and securing the necessary documentation, military personnel can take advantage of the benefits available to them. Remember to contact your local tax authority or legal advisor for personalized guidance based on your specific situation.

Online Guide to Military Vehicle Property Taxes

Online Guide to Military Vehicle Property Taxes

FAQ

- Are military spouses eligible for vehicle property tax exemptions? This varies by state. Some states extend benefits to spouses, while others do not.

- What if I purchase a vehicle while stationed in a different state than my domicile? You should register the vehicle in your state of domicile to potentially qualify for exemptions.

- Where can I find more information about state-specific military tax benefits? Contact the Department of Motor Vehicles or tax assessor’s office in the relevant state.

- Are there any federal tax benefits for military members regarding vehicles? While not directly related to property taxes, there may be other federal tax benefits available to military members.

- What if I disagree with a tax assessment? You typically have the right to appeal a vehicle property tax assessment through the appropriate state channels.

- Do I need to renew my vehicle property tax exemption annually? This depends on the specific state regulations. Some states require annual renewal, while others do not.

- Can I claim an exemption for multiple vehicles? This also depends on state laws. Some states limit the number of vehicles eligible for exemption.

Further Resources

For more information regarding financial resources for military families, you might find the article on how are social care services funded helpful. This resource provides valuable insights into support systems available to families.

Need Help?

For personalized assistance with your vehicle service and repair needs, contact us via WhatsApp: +1(641)206-8880 or Email: [email protected]. Our 24/7 customer support team is ready to help.