Simplifying Car Payment Services: Your Guide to Effortless Auto Financing

Car Payment Services have revolutionized how we finance our vehicles, offering a range of options from traditional loans to modern digital platforms. This comprehensive guide will explore the various car payment services available, helping you navigate the complexities and choose the best fit for your financial situation. After reading this, you’ll be equipped to confidently secure the car of your dreams.

Understanding the Landscape of Car Payment Services

Car payment services encompass a broad spectrum of financing options, each with its own set of advantages and disadvantages. Understanding these distinctions is crucial for making an informed decision.

Traditional Auto Loans

Traditional auto loans, offered through banks and credit unions, remain a popular choice. These loans involve borrowing a fixed amount and repaying it over a set period, typically with a fixed interest rate. While they offer stability, the application process can be lengthy.

Online Lenders

Online lenders have disrupted the auto financing market, providing quick approvals and competitive rates. Their digital platforms streamline the application process, making it significantly faster than traditional methods.

Dealership Financing

Dealerships often offer in-house financing, sometimes with attractive incentives like low APRs or cash back. However, it’s essential to compare these offers with other options to ensure you’re getting the best deal. Don’t be afraid to negotiate.

Lease-to-Own Programs

Lease-to-own programs allow you to drive a car while making regular payments, with the option to purchase the vehicle at the end of the lease term. This can be a viable option for individuals with less-than-perfect credit.

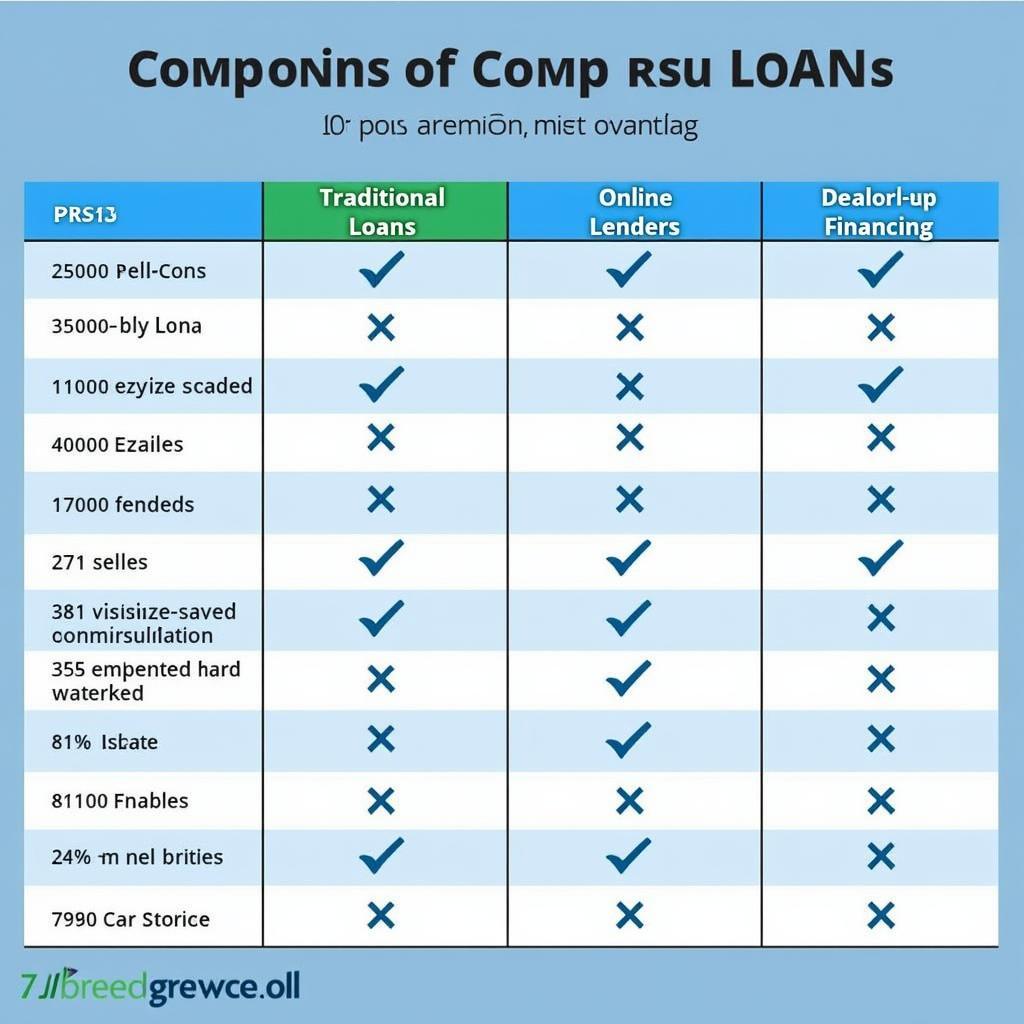

Comparing Car Loan Options

Comparing Car Loan Options

Choosing the Right Car Payment Service for You

Selecting the ideal car payment service depends on your individual financial circumstances and priorities.

Consider Your Credit Score

Your credit score plays a significant role in determining your eligibility for different loan types and interest rates. A higher credit score typically unlocks better terms. car service london to portsmouth

Evaluate Interest Rates and Fees

Carefully compare interest rates and fees across different lenders. Even a small difference in interest rates can significantly impact your overall cost. Be wary of hidden fees.

Assess Loan Terms

Loan terms, including the loan duration and monthly payment amount, should align with your budget and long-term financial goals. A shorter loan term means higher monthly payments but less interest paid overall.

Research Lender Reputation

Researching lender reputation is crucial before committing to a loan. Look for reviews and testimonials to gauge customer satisfaction and identify potential red flags.

Factors Affecting Car Loan Approval

Factors Affecting Car Loan Approval

What are the benefits of using car payment services?

Car payment services simplify the process of acquiring a vehicle, offering convenient payment methods and various financing options. They allow you to manage your car payments efficiently and often provide online tools for tracking your loan progress.

How can I find the best car payment service for my needs?

The best car payment service depends on your individual circumstances, including your credit score, budget, and desired loan terms. Comparing offers from multiple lenders and carefully reviewing the terms and conditions are crucial for finding the best fit.

Are there any risks associated with car payment services?

Like any financial product, car payment services carry certain risks, such as the possibility of accruing debt and facing penalties for late payments. It’s important to borrow responsibly and choose a reputable lender. atlantic car service app

Navigating the World of Car Payment Services

“Understanding the nuances of car payment services is paramount for making sound financial decisions,” says automotive financing expert, Amelia Hernandez, CFA. “Take the time to research, compare, and choose wisely.”

“Don’t rush into a car loan without thoroughly evaluating all your options,” adds David Lee, a seasoned auto loan advisor. “A little due diligence can save you significant money in the long run.” car service during corona virus

Car payment services provide valuable tools for financing a vehicle. By understanding the various options and carefully considering your financial situation, you can confidently navigate the auto financing landscape and drive away in the car of your dreams.

Conclusion

Car payment services offer a variety of options for financing your vehicle purchase. From traditional loans to innovative online platforms, finding the right service can simplify the process and make car ownership a reality. By carefully considering your financial situation and researching available options, you can confidently navigate the world of car payment services and secure the best terms for your next vehicle. cache https services.newport.gov.uk forms form 415 en car_park_penalty_payments car service baltimore to dulles

FAQ

- What is the difference between a loan and a lease?

- How does my credit score affect my car loan rate?

- What are the common fees associated with car loans?

- How can I improve my chances of getting approved for a car loan?

- What is the typical loan term for a car?

- What are the benefits of using an online car payment service?

- What should I do if I miss a car payment?

Common Car Payment Service Scenarios

- Scenario 1: A young professional with good credit is looking to finance their first new car. They should explore options with low APRs from online lenders and traditional banks.

- Scenario 2: An individual with poor credit needs a reliable vehicle. A lease-to-own program or a loan from a lender specializing in subprime lending might be suitable.

- Scenario 3: A family is looking to upgrade their vehicle and has a substantial down payment. They could consider a shorter-term loan to minimize interest payments.

Further Resources

- Explore our article on “Understanding Car Loan Interest Rates” for a deeper dive into how interest rates are calculated and how they impact your monthly payments.

- Check out our guide on “Negotiating the Best Car Deal” to learn effective strategies for securing the lowest price on your next vehicle.

Need assistance with your car payment services? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit our office at 456 Oak Avenue, Miami, FL 33101, USA. Our customer support team is available 24/7.