Navigating the Car Finance Financial Services Register

Understanding the Car Finance Financial Services Register is crucial when you’re looking to finance a new or used vehicle. It’s the key to making informed decisions and securing the best possible deal. This guide will walk you through everything you need to know, from what the register is to how it protects you as a consumer.

What is the Car Finance Financial Services Register?

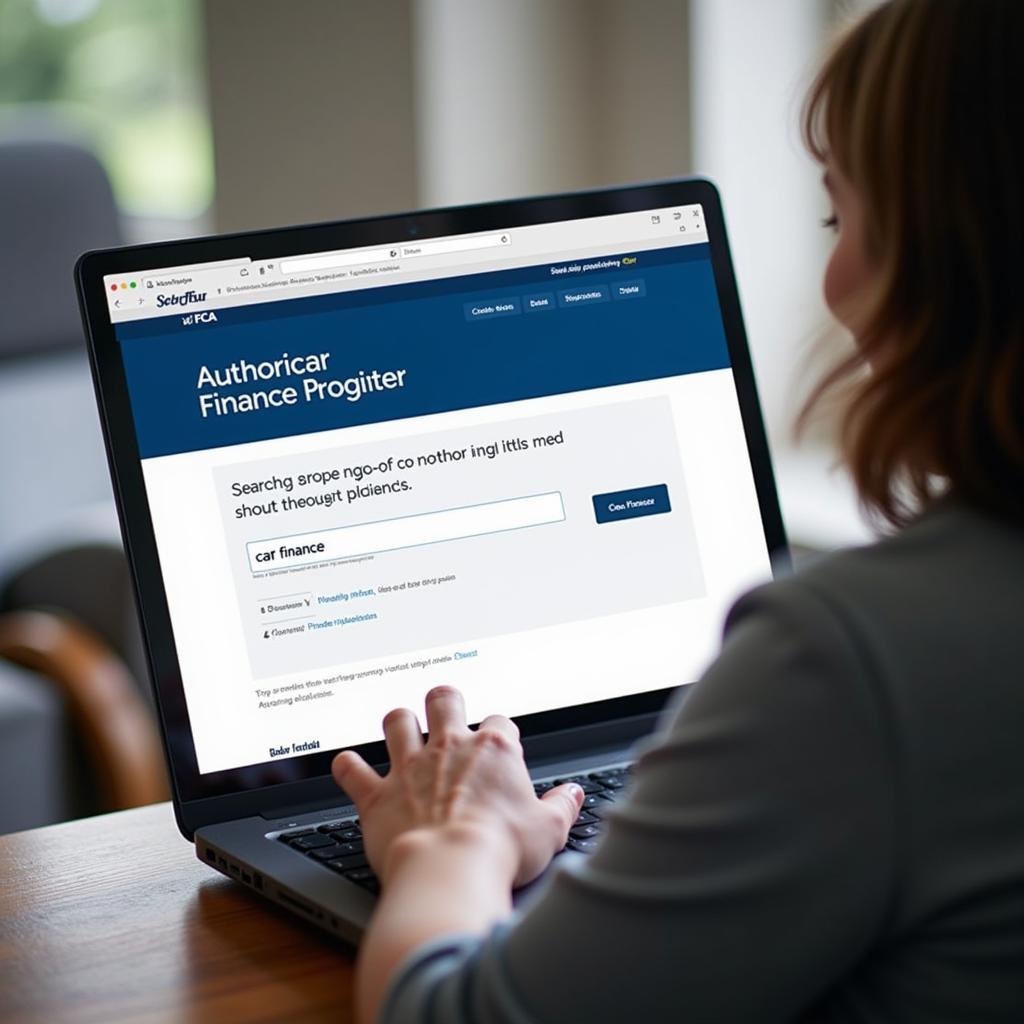

The car finance financial services register is a database of firms authorized by the Financial Conduct Authority (FCA) to offer car finance products. It helps consumers identify legitimate lenders and avoid potential scams. Checking the register before committing to a car finance agreement is essential. Doing so confirms you’re dealing with a reputable company operating within the legal framework.  Searching the Car Finance Financial Services Register

Searching the Car Finance Financial Services Register

Why is the Register Important?

The register protects consumers by ensuring that all listed firms adhere to strict regulations. This offers several key advantages. Firstly, it promotes transparency in lending practices. Secondly, it provides a mechanism for resolving disputes. Finally, it helps prevent predatory lending. Utilizing the register is a simple yet powerful way to safeguard your financial interests. Looking for information on car insurance? Check out our guide on car insurance financial services.

How to Use the Car Finance Financial Services Register

Using the register is straightforward. Simply visit the FCA website and search for the company offering the finance. You can search by company name or registration number. Verify the company’s authorization status and the types of financial services they’re permitted to offer. This simple check can save you from potential financial pitfalls. Need a template for your car service invoices? Our car service invoice template uk might be helpful.

Understanding Different Car Finance Options

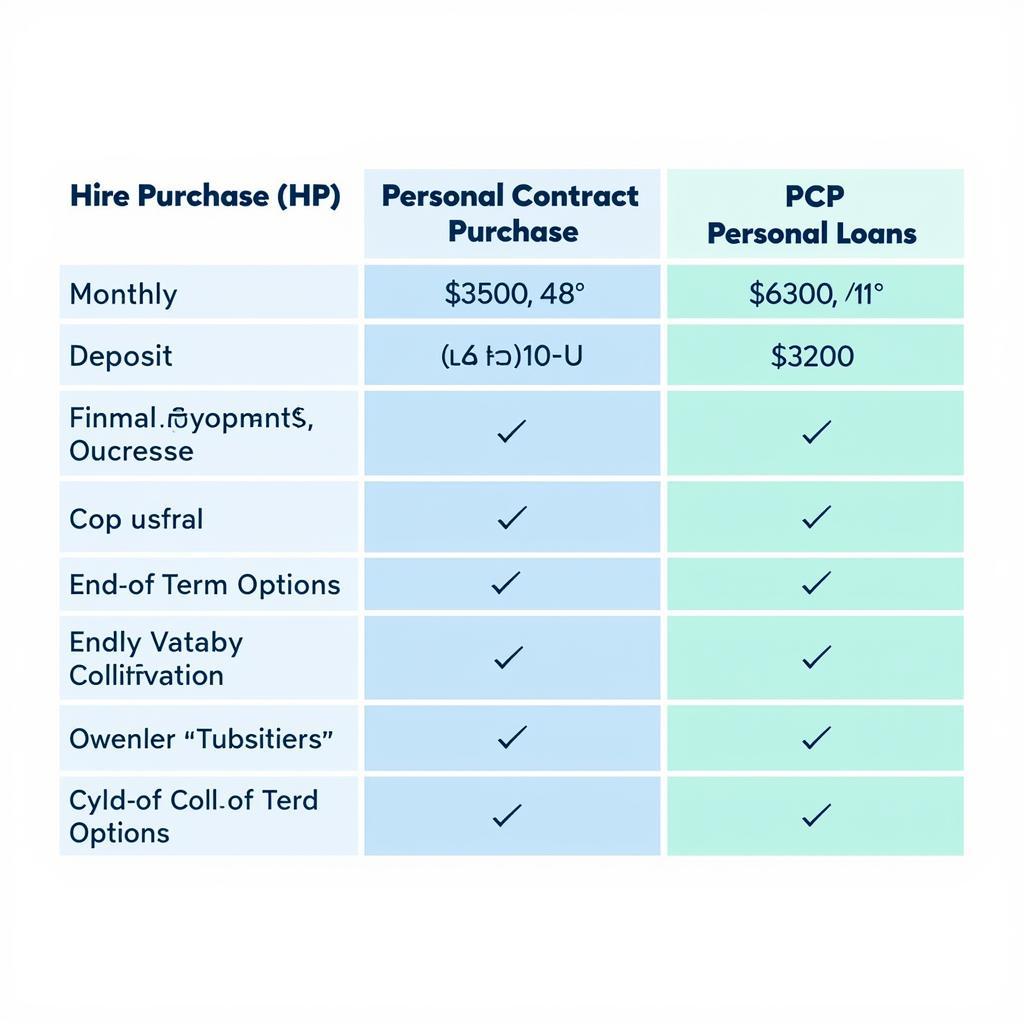

There are several types of car finance available, each with its own pros and cons. Understanding these options is crucial for choosing the best fit for your budget and needs. Common options include Hire Purchase (HP), Personal Contract Purchase (PCP), and personal loans. Each option has different implications for ownership, monthly payments, and overall costs.  Comparing Car Finance Options: HP, PCP, and Loan Considering starting your own car servicing business? Find out more about setting up a self-employed car servicing business: can i set up self empoyed servicing cars.

Comparing Car Finance Options: HP, PCP, and Loan Considering starting your own car servicing business? Find out more about setting up a self-employed car servicing business: can i set up self empoyed servicing cars.

Tips for Securing the Best Car Finance Deal

Securing the best car finance deal involves more than just checking the register. Shop around and compare offers from different lenders. Negotiate the interest rate and terms of the agreement. Consider your budget and affordability carefully. A little research and due diligence can save you significant money in the long run.

Conclusion

The car finance financial services register is an invaluable tool for anyone considering car finance. By using the register and understanding the different finance options, you can make informed decisions and secure the best possible deal. This empowers you to navigate the car finance landscape with confidence and avoid potential pitfalls.

FAQs

- What is the FCA? The Financial Conduct Authority (FCA) regulates financial services firms in the UK.

- Is it mandatory to check the register? While not legally required, it’s highly recommended to protect yourself.

- What if a company isn’t on the register? Do not engage with them for car finance.

- Can I report a company not on the register offering car finance? Yes, you can report them to the FCA.

- Does the register cover all types of car finance? It covers firms authorized to offer regulated car finance products.

- What other resources can I use to research car finance options? Independent financial advisors and comparison websites can be helpful.

- What should I do if I have a dispute with a car finance provider? Contact the Financial Ombudsman Service.

Need Assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 456 Oak Avenue, Miami, FL 33101, USA. Our customer service team is available 24/7.