Car Dealer Services Wells Fargo: Financing Your Dream Car

Car Dealer Services Wells Fargo offers a range of financing options to help you purchase your dream car. Understanding these services can simplify the car buying process and ensure you secure the best possible loan terms. This article will explore various aspects of Wells Fargo auto financing, providing valuable insights to empower you in your car-buying journey.

Understanding Wells Fargo Car Financing Options

Wells Fargo provides various auto loan options, including new and used car loans, refinancing, and lease buyouts. Each option caters to different needs and financial situations. Choosing the right option is crucial for managing your budget and securing favorable loan terms.

New Car Loans

Financing a new car through Wells Fargo can be a straightforward process. They offer competitive interest rates and flexible loan terms. Pre-approval can give you a clear understanding of your budget and strengthen your negotiating position at the dealership.

Used Car Loans

Wells Fargo also offers financing for used cars. The loan terms and interest rates may vary depending on the age and mileage of the vehicle. It’s important to compare rates and terms with other lenders to secure the best deal.

Refinancing Your Auto Loan

Refinancing your existing auto loan with Wells Fargo can potentially lower your monthly payments or reduce the overall interest paid. This can be a beneficial option if interest rates have dropped since you secured your original loan.

Lease Buyouts

If you’re leasing a vehicle and decide to purchase it at the end of the lease term, Wells Fargo can provide financing for the buyout. This can be a convenient option to seamlessly transition from leasing to owning.

Wells Fargo Auto Loan Application Process

Wells Fargo Auto Loan Application Process

Benefits of Choosing Wells Fargo for Car Dealer Services

Wells Fargo offers several advantages for car buyers seeking financing solutions. Their established reputation, extensive network, and online resources provide a convenient and reliable experience.

Established Reputation and Reliability

Wells Fargo is a well-known financial institution with a long history of providing auto loans. This can offer peace of mind knowing you’re working with a reputable lender.

Extensive Network of Dealerships

Wells Fargo partners with a vast network of dealerships across the country. This can streamline the financing process and provide access to a wide selection of vehicles.

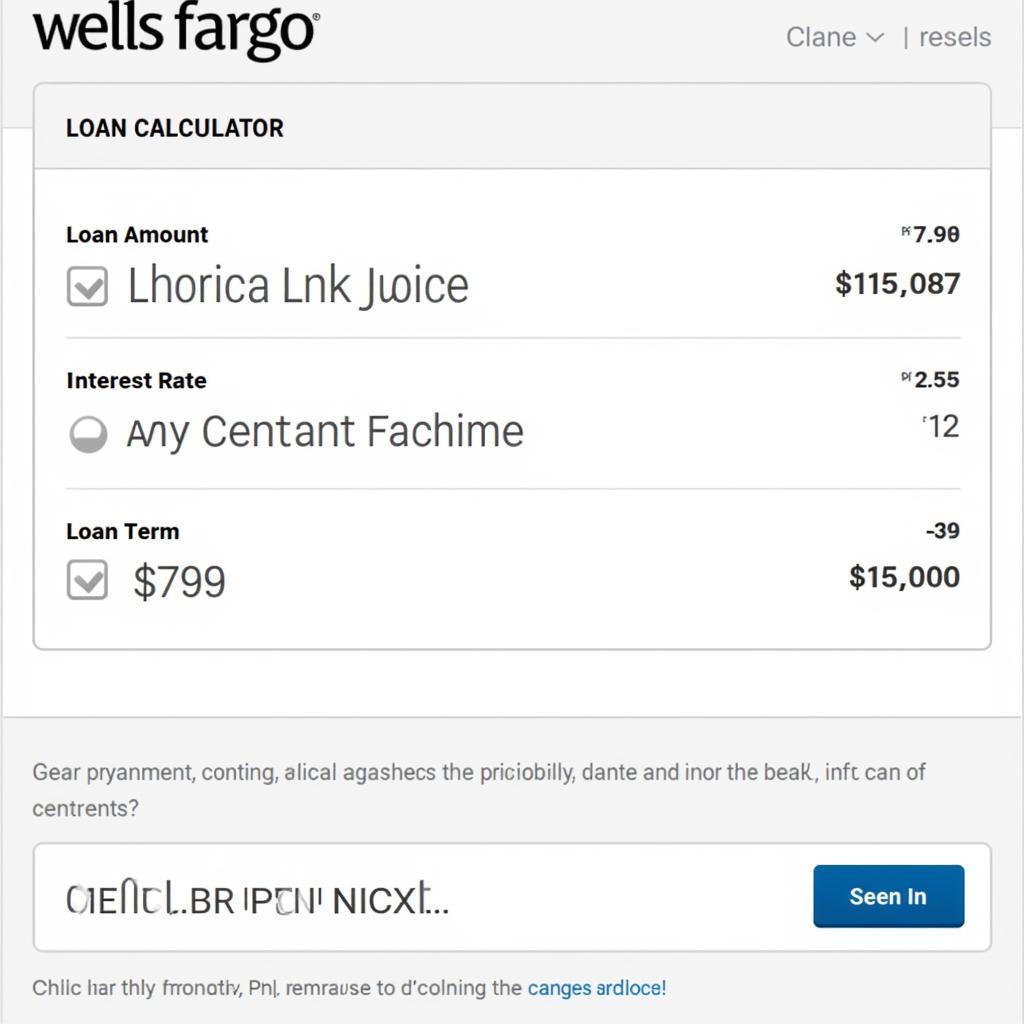

Online Resources and Tools

Wells Fargo provides a wealth of online resources, including loan calculators and pre-approval tools. These tools can help you estimate your monthly payments and determine your borrowing power.

Wells Fargo Online Auto Loan Calculator

Wells Fargo Online Auto Loan Calculator

Tips for Securing the Best Car Dealer Services with Wells Fargo

To maximize your chances of getting the best deal on your car loan, consider the following tips:

- Check your credit score: A good credit score can significantly impact the interest rate you qualify for.

- Shop around for rates: Compare loan offers from multiple lenders, including Wells Fargo, to find the most competitive rates and terms.

- Get pre-approved: Pre-approval can give you a clear understanding of your budget and strengthen your negotiating position.

- Negotiate the price of the car: Don’t be afraid to negotiate the price of the vehicle with the dealer.

- Read the fine print: Carefully review the loan agreement before signing to ensure you understand all the terms and conditions.

What are the requirements for a Wells Fargo auto loan?

Generally, Wells Fargo requires a good credit score, proof of income, and a valid driver’s license to qualify for an auto loan. Specific requirements may vary depending on the loan type and individual circumstances.

Wells Fargo Auto Loan Agreement Example

Wells Fargo Auto Loan Agreement Example

Conclusion

Car dealer services Wells Fargo offers a variety of financing options to help you purchase your dream vehicle. By understanding the different loan types, benefits, and tips for securing the best deal, you can confidently navigate the car-buying process. Remember to research, compare, and negotiate to ensure you secure the most favorable terms and enjoy your new car.

FAQ

- What is the maximum loan amount I can get from Wells Fargo?

- How long does it take to get approved for a Wells Fargo auto loan?

- Can I apply for a Wells Fargo auto loan online?

- What are the current interest rates for Wells Fargo auto loans?

- Does Wells Fargo offer any discounts on auto loans?

- What documents do I need to apply for a Wells Fargo auto loan?

- Can I pay off my Wells Fargo auto loan early?

Need further assistance? Reach out to our team via WhatsApp: +1(641)206-8880, or Email: [email protected]. We offer 24/7 customer support.