Budget Car Insurance Self Service Centre: A Comprehensive Guide

Budgeting for car insurance can be a significant expense, and finding ways to minimize costs is a priority for many drivers. A Budget Car Insurance Self Service Centre offers a potential solution, providing tools and resources to manage your policy and potentially reduce your premiums. This guide explores the benefits, potential drawbacks, and key features of utilizing a self-service centre for your budget car insurance needs.

Understanding Budget Car Insurance and Self Service

Budget car insurance focuses on providing essential coverage at a lower cost, often tailored to drivers with a clean driving record or those seeking minimum liability coverage. A self-service centre empowers you to take control of your policy online, from making payments and updating personal information to filing claims and accessing policy documents.

Many drivers opt for budget-friendly options when it comes to car insurance and utilizing a self-service platform can further reduce costs by eliminating agent fees and administrative expenses. This can be particularly appealing for those who are comfortable managing their finances and insurance needs online. However, it’s crucial to understand the trade-offs involved, such as potentially limited access to personalized advice from an insurance agent.

Benefits of a Self Service Centre

A budget car insurance self service centre offers several advantages: 24/7 Accessibility, allowing policy management anytime, anywhere. Instant Updates: Changes to your policy, like adding a new driver or updating your address, can be made quickly and efficiently. Cost Savings: Often, using a self-service portal can lead to discounts or lower administrative fees. Greater Control: You have direct access to your policy documents and can manage your coverage according to your needs.

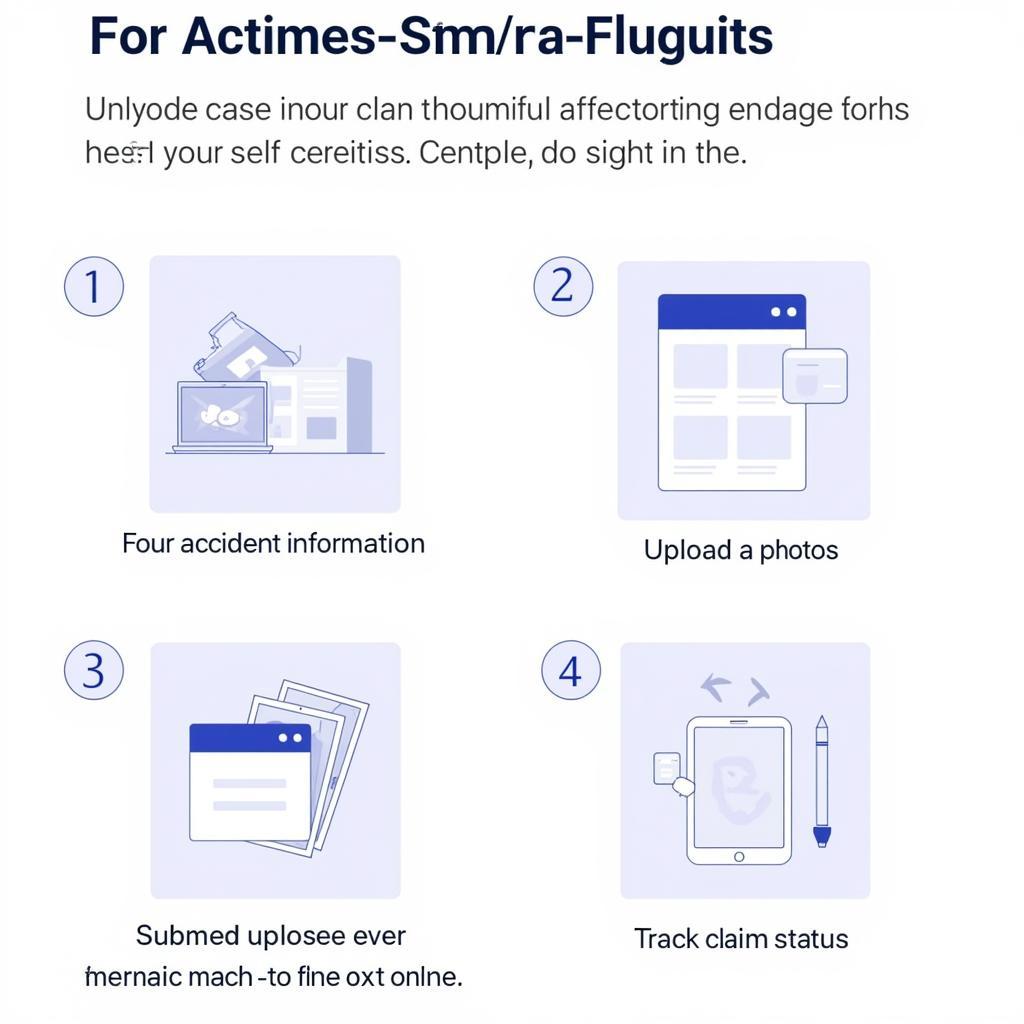

Self-Service Centre Claim Filing

Self-Service Centre Claim Filing

For those seeking [afford crewe car rental service], combining this with budget car insurance through a self-service platform can lead to significant overall savings on vehicle-related expenses. It’s a convenient way to streamline your car-related finances.

Navigating a Budget Car Insurance Self Service Centre

Before diving into a self-service platform, understand the available features and potential limitations. Ensure the platform offers the services you need, such as online claim filing, payment options, and access to policy documents.

Key Features to Look For

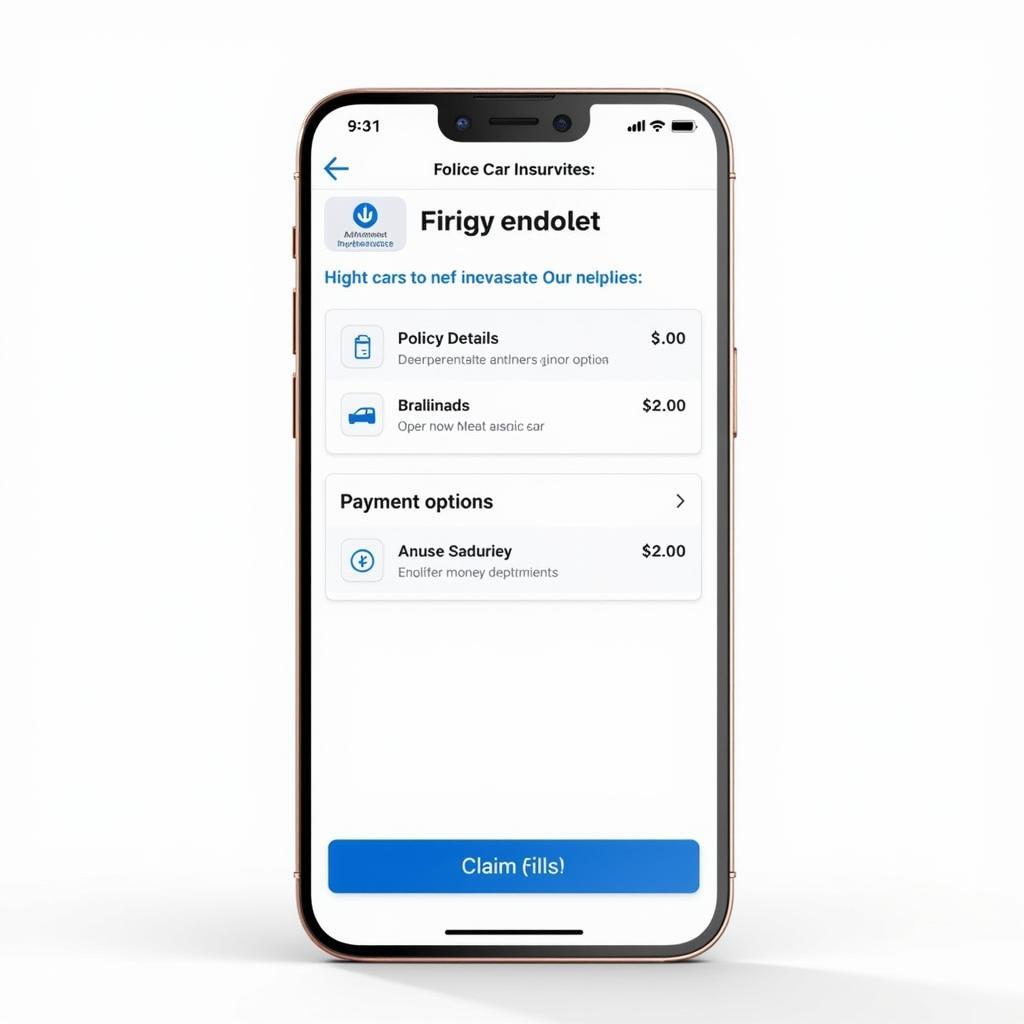

- User-Friendly Interface: A clean and intuitive design makes navigating the platform easy and efficient.

- Secure Access: Robust security measures protect your personal and financial information.

- Comprehensive Policy Management: The ability to make changes to your policy, view coverage details, and access documents is essential.

- Efficient Claim Filing: A streamlined online claim filing process simplifies reporting accidents and tracking claims.

- Accessible Customer Support: While self-service is the focus, readily available customer support channels for assistance are important.

Mobile-Friendly Self-Service App

Mobile-Friendly Self-Service App

John Smith, a senior insurance analyst at InsureWise, emphasizes, “The key to a successful self-service experience lies in a user-friendly interface and readily available support. Clients should feel empowered to manage their policies effectively without feeling overwhelmed or lost in the process.”

Choosing the Right Budget Car Insurance

While a self-service centre offers convenience, the underlying insurance policy remains the most crucial factor. Research different insurance providers, compare coverage options, and consider factors like deductibles, premiums, and customer reviews before making a decision. Services like [car loading services] or a [car recovery service aa] can impact your insurance needs, so consider these when choosing your policy. If you’re traveling abroad and need a [car and driver service dubai], ensuring your insurance covers international travel is vital.

Finding the right balance between budget-friendly coverage and comprehensive protection is key. Don’t compromise essential coverage simply for the lowest price. A self-service centre can empower you to manage your budget effectively, but it’s the quality of the insurance policy that provides true peace of mind. Even if you’re looking for a specific service like a [car ac service cost in delhi], understanding your car insurance can be beneficial.

Conclusion

A budget car insurance self service centre can be a valuable tool for managing your policy and potentially saving on costs. By understanding the benefits, features, and potential limitations, you can make an informed decision about whether a self-service approach is right for your budget car insurance needs. Remember to prioritize finding a reputable insurance provider with a solid policy that meets your individual requirements.

FAQ

- What is a budget car insurance self-service centre?

- How can I save money using a self-service centre?

- Is a self-service centre secure for managing my policy?

- What if I need assistance with my policy through a self-service centre?

- Can I file a claim online through a self-service centre?

- How do I choose the right budget car insurance policy?

- What are the key features of a good self-service platform?

Need further assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 456 Oak Avenue, Miami, FL 33101, USA. Our customer service team is available 24/7.