Bank of America Car Shopping Service: Your Guide to Easier Auto Financing

Bank Of America Car Shopping Service can simplify the often-daunting process of buying a car. In this comprehensive guide, we’ll delve into the benefits, features, and potential drawbacks of using this service to finance your next vehicle. From understanding the pre-approval process to navigating interest rates, we’ll equip you with the knowledge you need to make an informed decision.

Understanding the Bank of America Car Buying Service

The Bank of America car buying service bank of america car buying service aims to streamline your car-buying journey. It connects you with a network of dealerships, offers pre-approval for auto loans, and provides tools to help you research and compare vehicles. This service can be a valuable resource, particularly for those who prefer a more structured and guided approach to car shopping.

Benefits of Using the Service

- Pre-Approval: Knowing your budget beforehand empowers you to negotiate effectively. Bank of America’s pre-approval process gives you a clear understanding of your loan amount and interest rate, putting you in a stronger bargaining position.

- Dealer Network: Accessing a network of approved dealerships can save you time and effort. These dealerships often have pre-negotiated pricing and streamlined financing processes for Bank of America customers.

- Online Resources: Researching cars can be overwhelming. The Bank of America car shopping service provides tools and resources to compare models, check vehicle history reports, and estimate monthly payments.

- Convenience: Managing your car financing through your existing bank account can simplify your finances. You can easily track payments, manage your loan, and access customer support through familiar channels.

Bank of America Car Shopping Service Pre-Approval Process

Bank of America Car Shopping Service Pre-Approval Process

Potential Drawbacks to Consider

- Limited Dealer Choice: While the dealer network offers convenience, it may restrict your options compared to searching independently. You may miss out on deals from dealerships outside the network.

- Interest Rates: While pre-approval is helpful, it’s crucial to compare interest rates with other lenders. Bank of America’s rates may not always be the most competitive in the market.

- Pressure to Finance Through Bank of America: While the service offers various tools, there might be subtle pressure to finance through Bank of America, even if you find better terms elsewhere.

Navigating the Bank of America Car Shopping Service

Using the service effectively involves a few key steps: getting pre-approved, researching vehicles, finding a participating dealer, and negotiating the final price. Understanding these steps will help you maximize the benefits and navigate potential challenges.

Securing Pre-Approval

bank of america car buying service offers a straightforward pre-approval process. You’ll need to provide your financial information, including income, credit score, and existing debts. Once approved, you’ll receive a pre-approval letter outlining your loan amount, interest rate, and terms.

Finding the Right Car

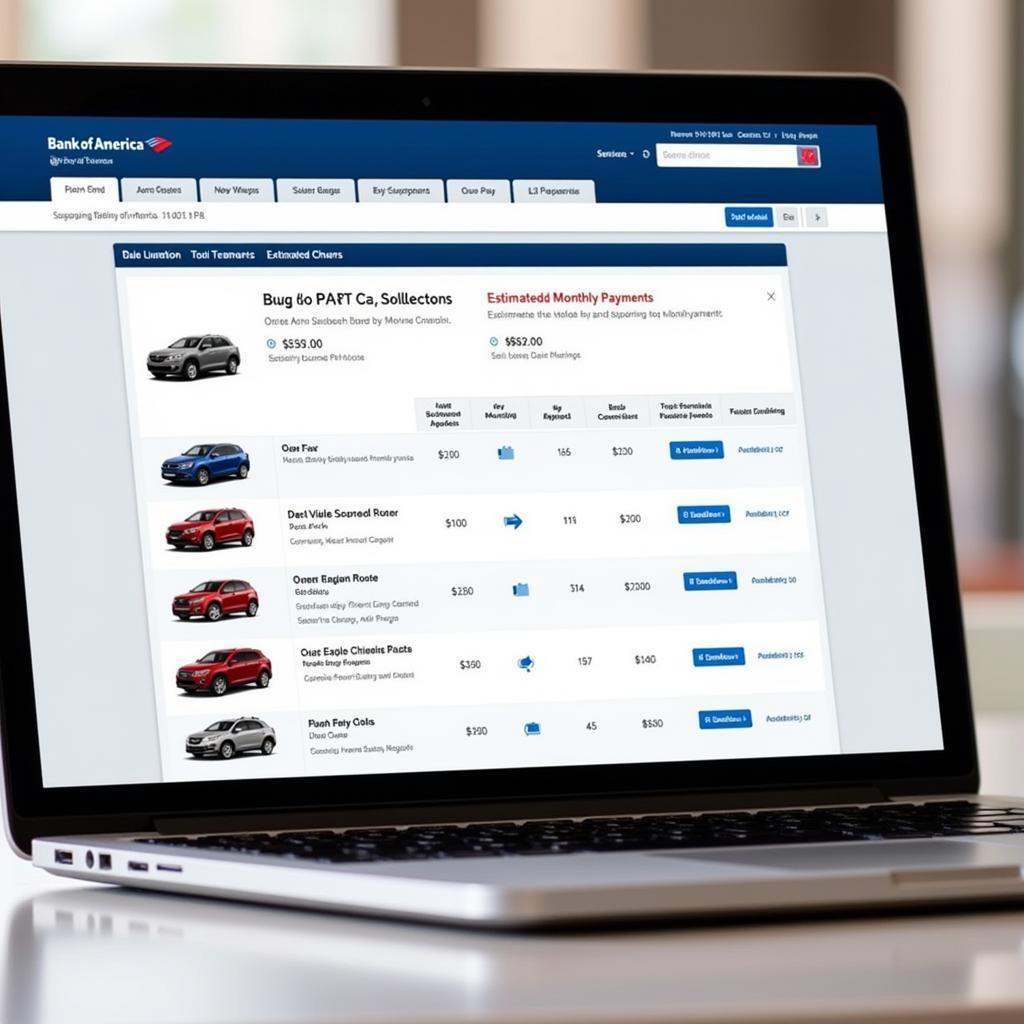

The Bank of America car shopping service provides tools to compare vehicles based on various criteria, such as fuel efficiency, safety ratings, and features. This can help you narrow down your choices and select a car that meets your needs and budget.

Comparing Cars on Bank of America Platform

Comparing Cars on Bank of America Platform

Tips for Using the Bank of America Car Shopping Service Effectively

- Shop Around for Interest Rates: Don’t settle for the first offer. Compare Bank of America’s interest rates with those offered by other banks and credit unions.

- Negotiate the Price: Even with pre-approval, negotiate the final price with the dealer. Don’t be afraid to walk away if you’re not satisfied with the deal.

- Read the Fine Print: Carefully review all loan documents before signing. Ensure you understand the terms, fees, and repayment schedule.

“Having a clear understanding of your financing options is crucial when buying a car,” says John Smith, Senior Auto Finance Advisor at ABC Financial. “Pre-approval gives you the power to negotiate confidently and avoid surprises down the road.”

Conclusion

Bank of America car shopping service can be a valuable tool for streamlining your car-buying process. By understanding the benefits, drawbacks, and how to use the service effectively, you can make a well-informed decision and drive away in your dream car with a financing plan that suits your needs. Remember to shop around for the best interest rates and always negotiate the final price.

FAQs

- What is the Bank of America car buying service?

- How do I get pre-approved for a car loan through Bank of America?

- What are the benefits of using the Bank of America car shopping service?

- Are there any downsides to using this service?

- Can I use the Bank of America car buying service to purchase a used car?

- What if I find a better interest rate elsewhere after getting pre-approved through Bank of America?

- How do I find a participating dealer in the Bank of America network?

Need more help with car services? Check out our other articles: bank of america car buying service

Need assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 456 Oak Avenue, Miami, FL 33101, USA. Our customer service team is available 24/7.