Are Army Child and Youth Services Child Care Tax Exempt?

Understanding the tax implications of child care can be confusing, especially for military families. Many parents wonder, are Army Child and Youth Services (CYS) child care expenses tax deductible? Let’s explore this question and other related tax benefits for military families.

Understanding Child and Youth Services (CYS)

Army CYS programs provide a range of services, including child care, for military families. These services are designed to support soldiers and their families, enabling them to focus on their duties and providing children with a safe and nurturing environment. However, the tax treatment of CYS fees is a common source of confusion.

Are CYS Fees Tax Deductible?

While CYS fees are not specifically tax deductible, they can be used to offset taxable income through the Child and Dependent Care Credit. This credit can significantly reduce your tax liability, making CYS services more affordable. The amount of the credit depends on your income and the amount you spent on child care.

Modern and well-equipped CYS facilities

Modern and well-equipped CYS facilities

Navigating the Child and Dependent Care Credit

To claim the Child and Dependent Care Credit, you’ll need to complete Form 2441, Child and Dependent Care Expenses. This form requires information about your qualifying child, the care provider (in this case, CYS), and the amount you paid for care. Keep accurate records of your CYS payments throughout the year. This will simplify the process when it’s time to file your taxes.

Who Qualifies for the Credit?

Generally, you can claim the credit if you paid child care expenses so you (and your spouse, if filing jointly) could work or look for work. There are specific income limitations and requirements for the child to be considered a qualifying person. The IRS provides detailed information on these qualifications.

Other Tax Benefits for Military Families

Beyond the Child and Dependent Care Credit, there are other tax advantages available to military families. These include the Earned Income Tax Credit, the Child Tax Credit, and various exclusions for military pay and benefits.

Exploring the Earned Income Tax Credit

The Earned Income Tax Credit (EITC) is a refundable tax credit for low- to moderate-income working individuals and families, including military personnel. This credit can provide a significant boost to your refund or reduce the amount of tax you owe.

Utilizing the Child Tax Credit

The Child Tax Credit helps offset the cost of raising children. Military families may be eligible for this credit, depending on their income and the age of their children.

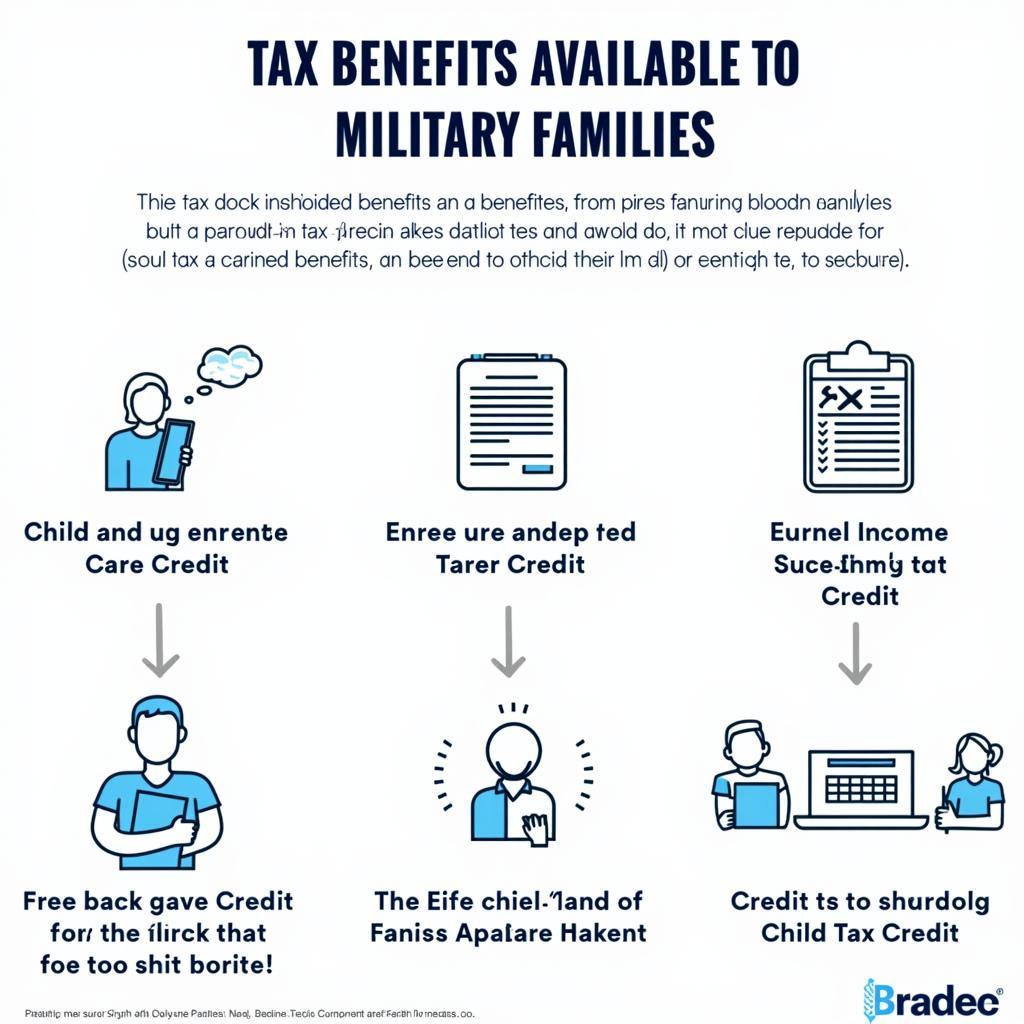

Exploring tax benefits for military families

Exploring tax benefits for military families

Conclusion: Maximizing Your Tax Benefits

Are Army Child And Youth Services Child Care Tax Exempt? While the fees themselves aren’t exempt, the Child and Dependent Care Credit offers valuable tax relief for military families utilizing CYS services. Understanding this credit, along with other available tax benefits, can help military families maximize their financial resources.

FAQ

- What is the maximum amount of expenses I can claim for the Child and Dependent Care Credit? The amount you can claim depends on your income and the number of qualifying children.

- Can I claim the Child and Dependent Care Credit if I am single? Yes, you can claim the credit as a single parent if you meet the eligibility requirements.

- Where can I find Form 2441? You can download Form 2441 and its instructions from the IRS website.

- Does the Child Tax Credit apply to children of any age? No, there are age limits for qualifying children for the Child Tax Credit.

- Are there any military-specific tax guides available? Yes, the IRS and various military organizations offer resources and publications specifically addressing military tax issues.

- How do I determine my eligibility for the Earned Income Tax Credit? The IRS provides an EITC Assistant tool online to help determine eligibility.

- What if I have questions about my specific tax situation? Consult a qualified tax professional for personalized advice.

For further assistance regarding car services and diagnostics, contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit our office at 456 Oak Avenue, Miami, FL 33101, USA. Our customer service team is available 24/7.