Applying for a Fuel and Car Service Card: A Comprehensive Guide

Applying For A Fuel And Car Service Card can significantly simplify fleet management and personal vehicle expenses. This guide explores the benefits, application process, and key considerations when choosing the right card for your needs. We’ll delve into various card types, eligibility criteria, and tips for maximizing your savings. After reading this, you’ll be equipped to make an informed decision and streamline your car-related expenditures. Check out our guide on car greasing service for more helpful tips.

Understanding Fuel and Car Service Cards

Fuel and car service cards offer a convenient way to manage fuel purchases and other vehicle-related expenses. They provide a centralized payment system, detailed reporting, and potential discounts. These cards can be beneficial for both businesses managing fleets and individuals looking to control their motoring costs. What are the different types of fuel and car service cards available?

Types of Fuel and Car Service Cards

There are several types of cards tailored to different needs. Fuel-only cards are specifically for fuel purchases at designated gas stations. Universal cards, like some credit cards, offer broader acceptance and can be used for other expenses besides fuel. Merchant-specific cards are tied to particular brands, such as Shell or ExxonMobil, often offering exclusive discounts and rewards. Fleet cards are designed for businesses managing multiple vehicles, providing comprehensive reporting and control features.

Choosing the right card depends on your specific requirements and spending habits. Do you prioritize fuel discounts, widespread acceptance, or detailed expense tracking? Consider these factors when making your decision. Learn more about administering your car service plan effectively.

Applying for a Fuel and Car Service Card: A Step-by-Step Guide

The application process is typically straightforward and can often be completed online. While specific requirements vary between providers, the general steps are similar.

Gathering Necessary Information

Before applying, gather essential information like your personal details, business information (if applicable), driver’s license number, and vehicle information. Having this information readily available will expedite the application process.

Completing the Application Form

Fill out the application form accurately and completely. Provide all requested information, as incomplete applications can lead to delays or rejection.

Reviewing the Terms and Conditions

Carefully review the terms and conditions, including fees, interest rates, and payment schedules. Understanding the terms is crucial for avoiding unexpected charges and maximizing benefits. For information on car service categories, visit our dedicated page.

Submitting the Application

Once you’ve reviewed the terms and conditions, submit your application. You’ll typically receive a confirmation email or notification.

Awaiting Approval

After submission, the provider will review your application. The approval time varies depending on the provider and your credit history.

“Choosing the right fuel card can significantly impact your bottom line,” says John Davis, Fleet Manager at Logistics Inc. “Take the time to compare options and select a card that aligns with your business needs.”

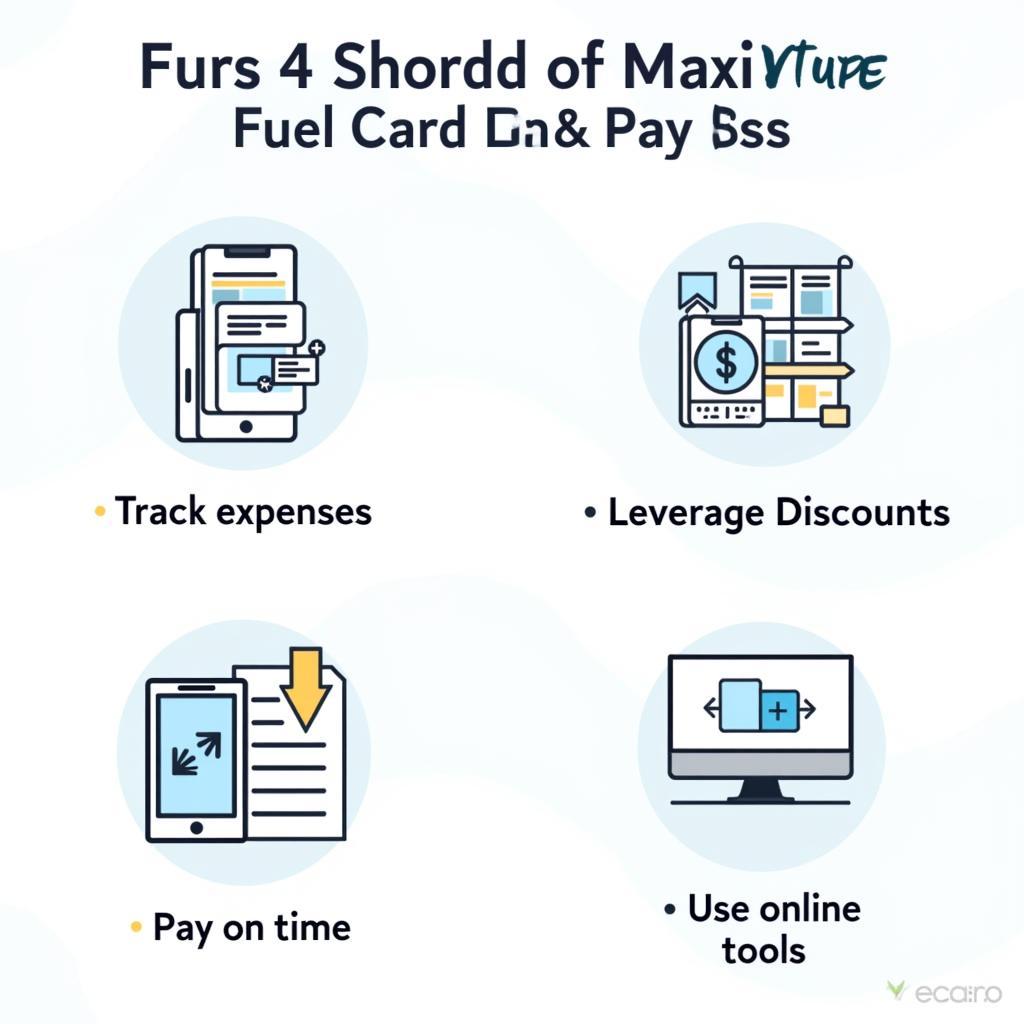

Maximizing Your Fuel and Car Service Card Benefits

Once approved, use your card strategically to maximize its benefits. Take advantage of discounts, track your expenses diligently, and pay your balance on time to avoid interest charges.

Tracking Expenses and Budgeting

Fuel and car service cards provide detailed reports of your spending, facilitating better budgeting and expense management. Utilize these reports to identify areas for potential savings. Find affordable car cleaning services near me prices.

Leveraging Discounts and Rewards

Many cards offer discounts on fuel purchases, car washes, and other services. Maximize your savings by utilizing these offers.

Tips for Maximizing Fuel Card Benefits

Tips for Maximizing Fuel Card Benefits

Maintaining Good Credit

Maintaining good credit is essential for securing favorable terms and maximizing your benefits. Pay your balance on time and avoid exceeding your credit limit.

Conclusion

Applying for a fuel and car service card can be a smart financial move for both individuals and businesses. By understanding the different types of cards available and following the application process diligently, you can streamline your vehicle expenses and potentially save money. Remember to compare options, review the terms and conditions carefully, and use your card strategically to maximize its benefits. Applying for a fuel and car service card is a simple process that can offer significant long-term rewards. You can find more information about car service Newcastle NSW on our site.

FAQs

- What are the typical fees associated with fuel and car service cards?

- How can I check my fuel card balance?

- What happens if my fuel card is lost or stolen?

- Can I use my fuel card internationally?

- Are there any credit score requirements for fuel cards?

- How do I choose the right fuel card for my business?

- What are the benefits of using a fuel card for personal use?

Need help with your car diagnostics? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 456 Oak Avenue, Miami, FL 33101, USA. We have a 24/7 customer support team ready to assist you.