Bank of Scotland Self Service Car: A Comprehensive Guide

Bank of Scotland self service car options, like car loans and financing, are crucial for many looking to purchase their dream vehicle. Understanding the process, available options, and potential pitfalls is essential for securing the best deal and managing your finances effectively. This guide explores everything you need to know about navigating car financing through Bank of Scotland’s self-service platforms and beyond.

Understanding Bank of Scotland Self Service Car Financing Options

Bank of Scotland offers various self-service tools and resources for car financing. These online platforms allow you to explore loan options, calculate potential monthly payments, and even pre-apply for financing from the comfort of your home. This convenient approach empowers you to take control of the car buying process and make informed decisions.

Exploring Loan Options Online

The Bank of Scotland website provides detailed information on various car loan products. You can compare interest rates, loan terms, and other crucial factors to find the option that best suits your budget and needs. Their online calculators can help you estimate monthly payments based on different loan amounts and repayment periods.

Pre-Approval and Application Process

Bank of Scotland’s online platform also allows you to get pre-approved for a car loan. This pre-approval can strengthen your negotiating position with dealerships, as you’ll know exactly how much financing you qualify for. The online application process is generally straightforward, requiring personal and financial information.

Managing Your Car Loan Online

Once you’ve secured a car loan, Bank of Scotland’s online banking platform allows you to manage your loan effectively. You can view your balance, make payments, and track your repayment progress all in one place. This convenient access ensures you stay on top of your finances and avoid potential late payment fees.

Beyond Bank of Scotland: Exploring Other Car Financing Avenues

While Bank of Scotland offers convenient self-service options, exploring other financing avenues is always advisable. Comparing offers from different lenders, including credit unions and other banks, can help you secure the most competitive interest rates and loan terms.

Dealership Financing: Pros and Cons

Car dealerships often offer financing options through their partnerships with lenders. While convenient, dealership financing may not always offer the best rates. It’s crucial to compare these offers with those from other lenders before making a decision.

Credit Unions: A Potential Alternative

Credit unions often offer competitive interest rates and personalized service. They can be a viable alternative to traditional banks, especially if you’re a member or eligible to join.

Tips for Securing the Best Car Loan

Regardless of where you choose to finance your car, these tips can help you secure the best possible deal:

- Check your credit score: A good credit score can significantly impact the interest rate you qualify for.

- Shop around and compare offers: Don’t settle for the first offer you receive. Comparing offers from multiple lenders ensures you get the best deal.

- Negotiate the loan terms: Don’t be afraid to negotiate the interest rate, loan term, and other fees.

- Read the fine print: Carefully review the loan agreement before signing to understand all the terms and conditions.

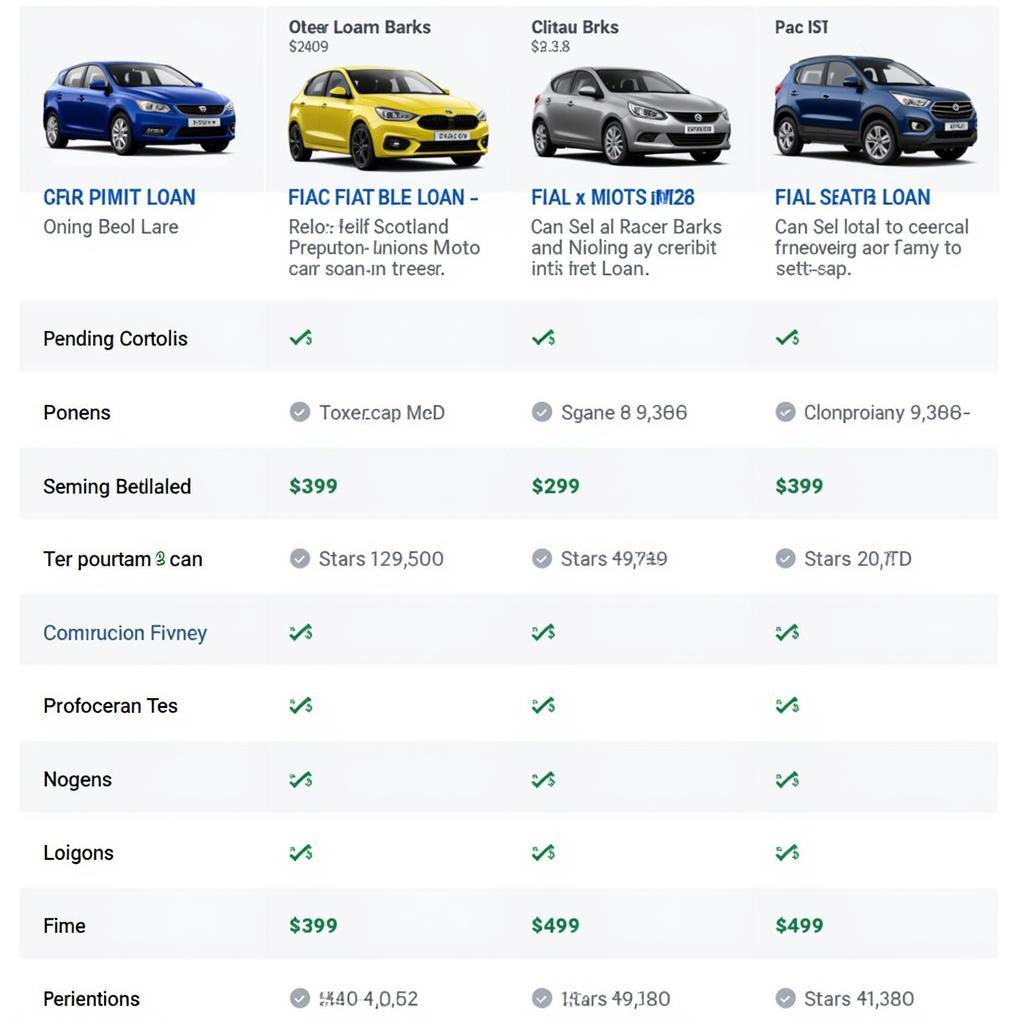

Comparing Car Loan Offers

Comparing Car Loan Offers

Conclusion: Navigating the Road to Car Ownership with Bank of Scotland Self Service Car Financing

Bank of Scotland self service car financing options offer a convenient and accessible way to finance your vehicle. However, remember to explore all available options, compare offers, and negotiate the best terms to ensure you drive away with a deal that fits your financial goals. By being informed and proactive, you can make the car buying process smoother and more rewarding.

FAQ

- Can I apply for a car loan online with Bank of Scotland? Yes, Bank of Scotland offers online application facilities for car loans.

- What documents do I need for a car loan application? Typically, you’ll need proof of income, identification, and address verification.

- How long does the car loan approval process take? The approval process can vary but is often completed within a few business days.

- Can I pre-pay my car loan? Most car loans allow pre-payment, but it’s essential to check for any potential penalties.

- What happens if I miss a car loan payment? Missing a payment can negatively impact your credit score and incur late fees.

Need further assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit our office at 456 Oak Avenue, Miami, FL 33101, USA. We have a 24/7 customer support team ready to help.