How to Use MCU Car Buying Service

Navigating the car buying process can be overwhelming. Using an MCU (Member Credit Union) car buying service can simplify things and potentially save you money. This guide explains How To Use Mcu Car Buying Services to your advantage, covering everything from initial research to finalizing your purchase.

Understanding MCU Car Buying Services

MCU car buying services act as your personal car concierge. They partner with dealerships to pre-negotiate prices, often below market value. They handle much of the legwork, saving you time and stress. Plus, they can help you secure financing through your credit union, potentially with lower interest rates than dealerships offer. What’s not to love?

How to Use an MCU Car Buying Service: A Step-by-Step Guide

-

Contact Your Credit Union: Reach out to your MCU and inquire about their specific car buying service. They’ll explain the details of their program and connect you with a representative.

-

Specify Your Needs: Clearly define your dream car, including make, model, features, and budget. The more specific you are, the better the service can tailor its search. Do you need an SUV? A fuel-efficient sedan? Be upfront about your must-haves.

-

Review Provided Options: The MCU car buying service will present you with a list of vehicles matching your criteria, including pre-negotiated prices and dealer information. This saves you the hassle of haggling and visiting multiple dealerships.

-

Visit the Dealership (Optional): While not always necessary, you may want to test drive the car and see it in person before making a decision. The MCU representative can schedule this visit for you.

-

Finalize Financing: Your MCU can assist with financing through the credit union, potentially offering better loan terms. This streamlines the process and ensures you get a competitive rate.

-

Complete the Purchase: Once you’re satisfied with the vehicle and financing, the MCU representative will guide you through the final paperwork and delivery process. They’re there every step of the way.

Benefits of Using an MCU Car Buying Service

- Pre-Negotiated Prices: Save money upfront with prices typically lower than those negotiated independently.

- Time Savings: Avoid spending hours researching and haggling at dealerships.

- Streamlined Financing: Access competitive loan rates and a simplified financing process.

- Reduced Stress: Let the MCU handle the complexities of car buying.

- Expert Advice: Benefit from the knowledge and experience of MCU representatives.

What to Consider When Choosing an MCU Car Buying Service

Not all MCU car buying services are created equal. Consider these factors when selecting a service:

- Partner Dealerships: Research the dealerships your MCU works with to ensure they have a good reputation and offer a wide selection of vehicles.

- Fee Structure: Some MCUs may charge a small fee for their car buying service. Understand any associated costs upfront.

- Customer Reviews: Check online reviews and testimonials to gauge the satisfaction of other members who have used the service.

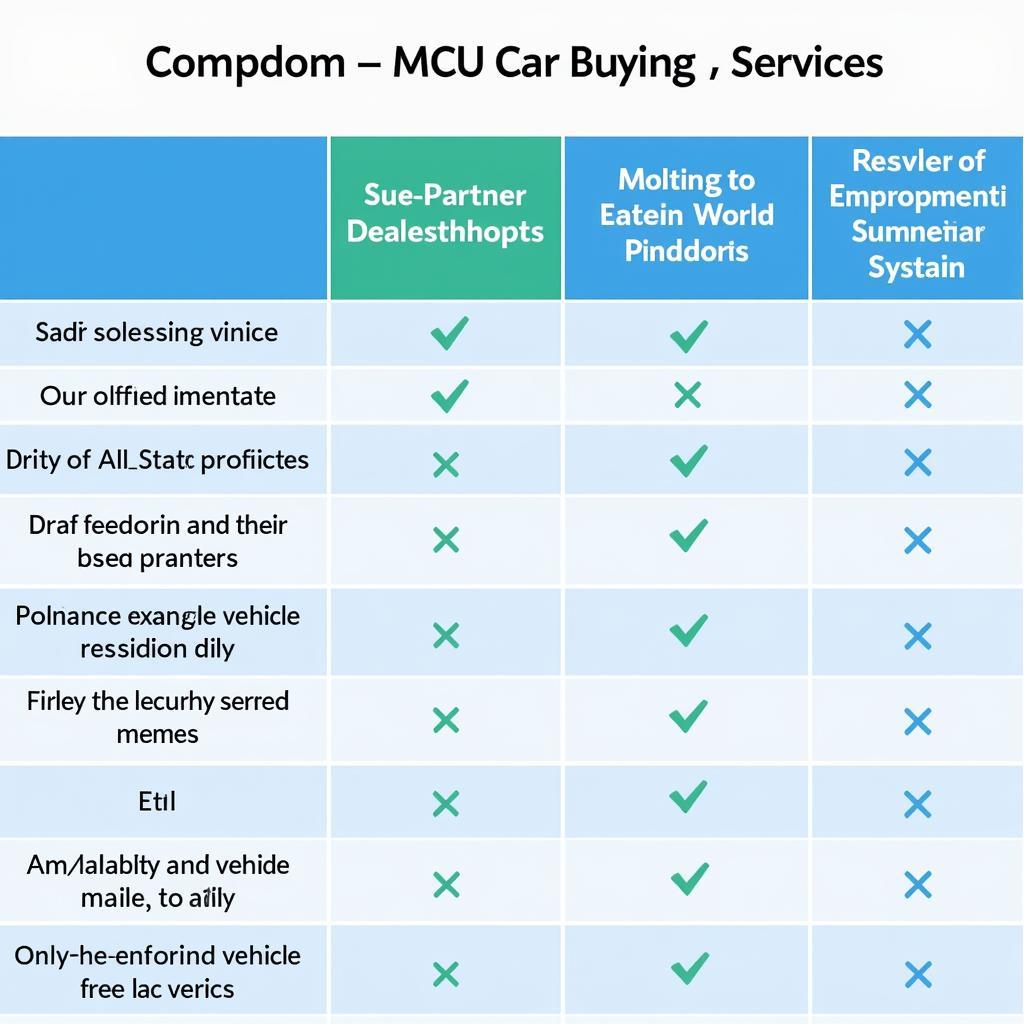

Comparing MCU Car Buying Services

Comparing MCU Car Buying Services

How Can I Find the Best Deals Using MCU Car Buying Service?

Being upfront about your budget and desired features helps your representative find the best deals. Also, be flexible with your choices. Sometimes, a slightly different model or trim level can offer significant savings.

“Being proactive and communicative with your MCU representative is key to finding the perfect car at the right price,” says John Smith, Senior Automotive Advisor at First National Credit Union.

Is Using an MCU Car Buying Service Right for Me?

If you value convenience, saving money, and reducing stress during the car buying process, then an MCU car buying service is likely a good fit. It’s especially beneficial for those who are uncomfortable negotiating or have limited time to dedicate to car shopping.

“An MCU car buying service empowers members with the tools and resources they need to make informed decisions and secure the best possible deal,” adds Jane Doe, Financial Advisor at Community Credit Union.

Happy Customer Receiving Car Keys

Happy Customer Receiving Car Keys

Conclusion

Utilizing an MCU car buying service can simplify and optimize your car buying journey. By leveraging pre-negotiated prices, streamlined financing, and expert advice, you can save time, money, and stress while securing the car of your dreams. So, consider contacting your MCU today and explore the benefits of their car buying service. How to use MCU car buying service effectively boils down to communication and leveraging the expertise your credit union provides.

FAQ

- Do all credit unions offer car buying services? Not all, but many do. Check with your specific credit union.

- Are there fees associated with using an MCU car buying service? Some MCUs may charge a small fee. Inquire about this beforehand.

- Can I still negotiate the price at the dealership? While the price is often pre-negotiated, there might be some room for further discussion.

- What types of vehicles are available through MCU car buying services? A wide range, including new and used cars, trucks, and SUVs.

- Can I use my own financing instead of going through the credit union? Yes, but you might miss out on potentially better rates.

- How long does the process typically take? It varies, but it’s often faster than traditional car buying.

- What if I’m not happy with the service? Contact your MCU representative to address any concerns.

Situations for using MCU Car Buying Services:

- First-time car buyer: Overwhelmed by the process? Let the MCU guide you.

- Busy professionals: Limited time? Save time and hassle with the MCU.

- Those seeking the best deals: Pre-negotiated prices can save you money.

Further Reading:

- Car Loan Calculator

- Understanding Auto Insurance

- Maintaining Your New Vehicle

When you need help, don’t hesitate to contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 456 Oak Avenue, Miami, FL 33101, USA. Our customer service team is available 24/7.