What is Point of Service Managed Care?

Point of service (POS) managed care plans combine features of Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). They offer flexibility in choosing healthcare providers while attempting to control costs. Understanding how POS plans work can help you make informed decisions about your healthcare coverage.

Choosing the right healthcare plan can be daunting. With POS plans, you have the freedom to see specialists outside your network, but at a higher cost. This flexibility can be beneficial, especially if you need to see a specialist not covered by your network. Let’s delve into the details of POS plans and how they can benefit you. Learn more about different types of healthcare plans, such as what is a point of service health care plan.

Understanding POS Managed Care

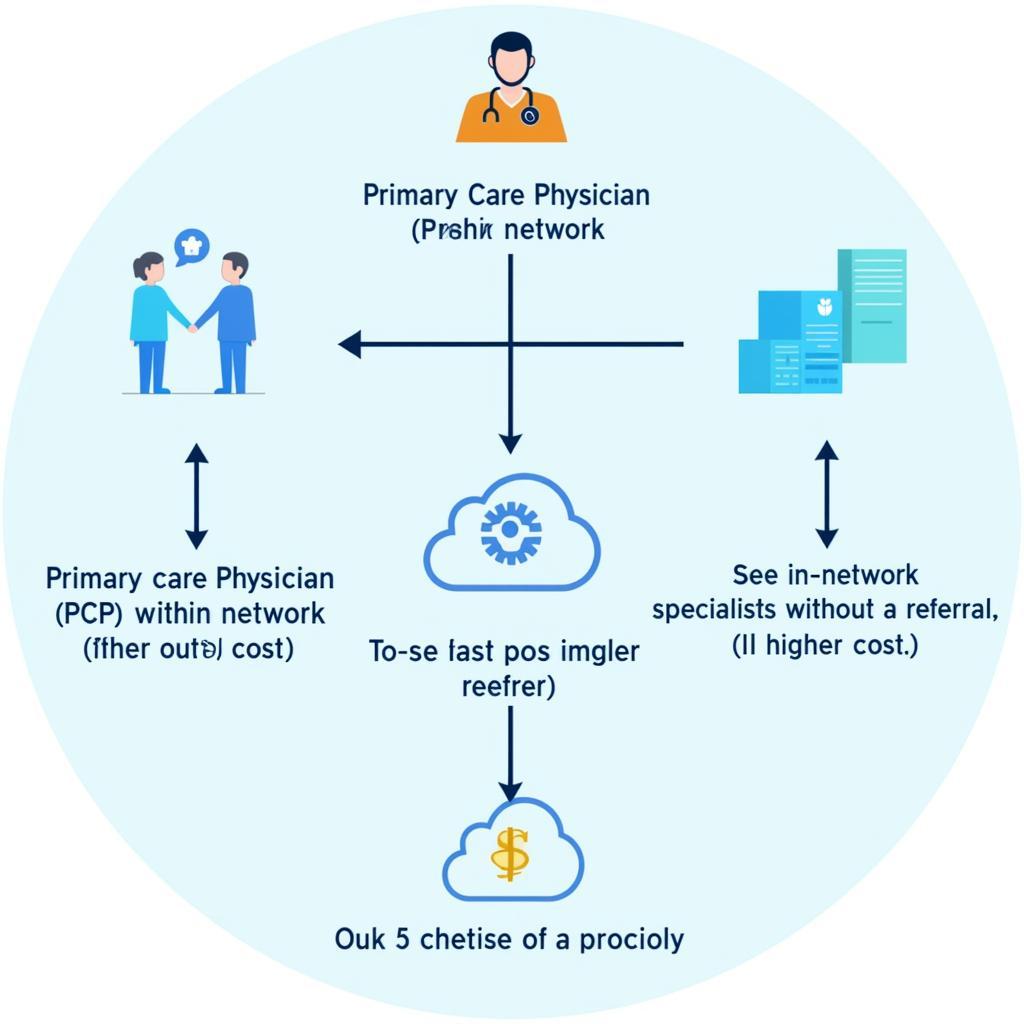

A POS plan requires you to designate a primary care physician (PCP) within the plan’s network. This PCP acts as your gatekeeper, coordinating your care and referring you to specialists when needed. While you can see in-network specialists with a referral, the key difference with POS plans lies in the option to see out-of-network providers without a referral, although at a higher cost-sharing.

How Does a POS Plan Work?

The core functionality of a POS plan revolves around the concept of a network. Staying within the network means lower costs for you. However, unlike an HMO, a POS plan gives you the option to venture outside the network when necessary, though it comes with increased expenses. This added flexibility provides greater control over healthcare decisions. Understanding the intricacies of managed care can be crucial; explore more on what are managed care services.

Diagram of Point of Service Managed Care Flow

Diagram of Point of Service Managed Care Flow

Advantages and Disadvantages of POS Plans

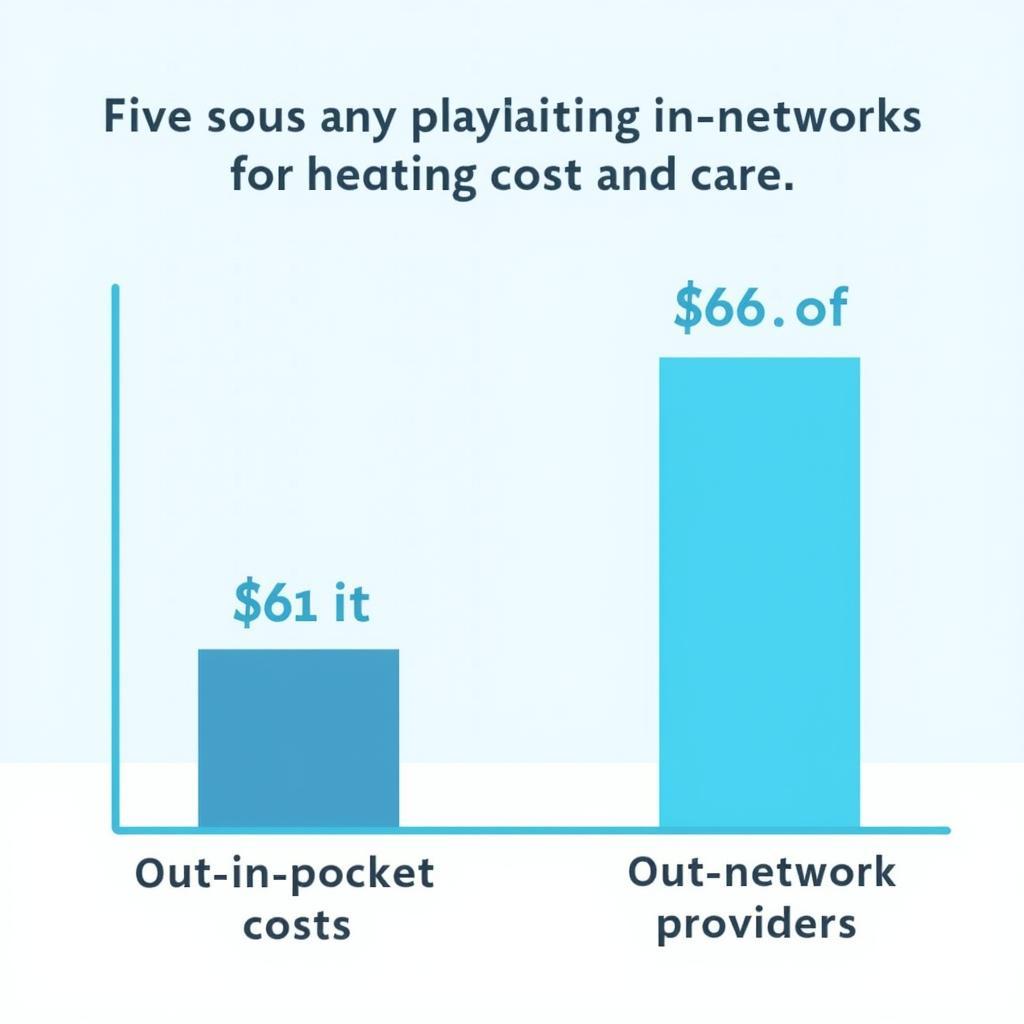

Like any healthcare plan, POS plans have their pros and cons. The flexibility to see out-of-network providers is a significant advantage, offering access to a broader range of specialists. However, this flexibility comes at a price, with higher out-of-pocket costs for out-of-network care. Understanding these trade-offs is crucial in determining if a POS plan is the right fit for you. You might also be interested in learning about specific programs that cover mental health services, as discussed in which managed long term care program covers mental health services.

Is a POS Plan Right For Me?

Determining if a POS plan is the right choice depends on your individual healthcare needs and preferences. If you value flexibility and are willing to pay more for it, a POS plan might be a good fit. However, if you prioritize cost savings and are comfortable with a more restricted network, an HMO might be a better option. It’s crucial to weigh your priorities and consider your healthcare needs when making a decision. To get a clearer understanding of medical care as a service, check out what type of service is medical care.

POS Plan Cost Comparison Chart

POS Plan Cost Comparison Chart

“POS plans offer a balance,” says Dr. Emily Carter, a healthcare policy expert. “They provide more choice than HMOs but are generally less expensive than PPOs, making them a viable option for many.”

Navigating the Network

Understanding your plan’s network is crucial for maximizing benefits and minimizing costs. A comprehensive provider directory will list all the doctors and hospitals within your network. It’s essential to verify a provider’s network status before scheduling an appointment to avoid unexpected charges. Medi-Cal also offers healthcare services, find more information about it on what is health care services in medi-cal.

“Knowing your network can save you significant money,” adds Dr. Michael Davis, a family physician. “Always check your provider directory before seeking care to avoid unnecessary out-of-pocket expenses.”

In conclusion, point of service managed care plans offer a blend of flexibility and cost control. Understanding how these plans work, their advantages and disadvantages, and the importance of navigating the network can empower you to make informed decisions about your healthcare coverage. Choosing the right plan is a crucial step in ensuring access to quality and affordable care.

FAQ

- What is the main difference between a POS plan and an HMO?

- How do I find a doctor in my POS plan’s network?

- What happens if I see an out-of-network provider without a referral?

- Do POS plans cover preventative care?

- How do I choose between a POS plan and a PPO plan?

- What is the role of a primary care physician (PCP) in a POS plan?

- Can I change my PCP in a POS plan?

Need more assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected], or visit us at 456 Oak Avenue, Miami, FL 33101, USA. Our 24/7 customer service team is ready to help.