Car Insurance for Emergency Service Workers: Finding the Best Coverage

Car Insurance For Emergency Service Workers can be a complex topic. This article aims to simplify the process and provide valuable insights into securing the best possible coverage. We’ll delve into the unique needs of emergency responders and how to find policies tailored to their demanding professions.

Understanding the Needs of Emergency Service Workers

Emergency service workers face unique challenges that impact their car insurance needs. Long shifts, unpredictable schedules, and the inherent risks associated with their professions can influence premiums and coverage options. Often, these professionals use their personal vehicles to respond to emergencies, increasing mileage and potential risks. Therefore, finding a policy that acknowledges these factors is crucial. This could include discounts for emergency service personnel or specific coverage for work-related incidents. Additionally, understanding how commuting versus responding to a call affects coverage is essential for informed decision-making.

Car Insurance for Emergency Responders

Car Insurance for Emergency Responders

Exploring Car Insurance Options for Emergency Responders

Several insurance providers offer specialized coverage or discounts for emergency service workers. Researching these options is crucial for finding the best rates and coverage. Compare quotes from different companies, paying attention to coverage details, deductibles, and potential discounts. Consider factors like roadside assistance, rental car reimbursement, and accident forgiveness programs. Don’t hesitate to contact insurance agents directly to discuss your specific needs and understand the intricacies of each policy. Being proactive in your research can lead to significant savings and peace of mind.

car insurance for emergency service workers uk

Key Factors Affecting Insurance Premiums

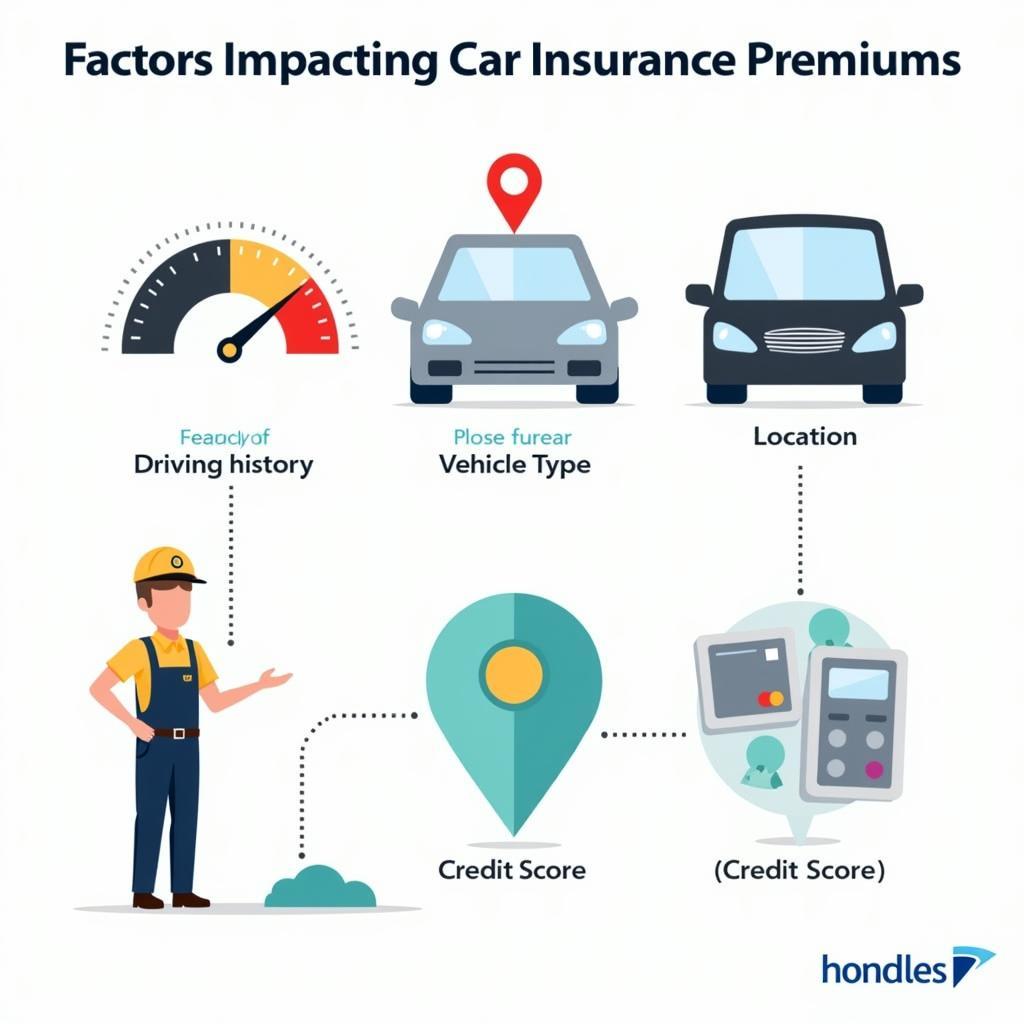

Several factors can influence car insurance premiums for emergency service workers. Driving history plays a significant role, with a clean record often resulting in lower premiums. The type of vehicle also matters, as high-performance or luxury cars typically command higher insurance rates. Location is another critical factor, with urban areas often associated with higher premiums due to increased traffic density and accident rates. Finally, credit score can also influence insurance costs in some regions. Maintaining a good credit score can potentially lead to more favorable insurance terms.

Factors Affecting Car Insurance Premiums for Emergency Personnel

Factors Affecting Car Insurance Premiums for Emergency Personnel

How to Find the Right Car Insurance

Finding the right car insurance for emergency service workers requires careful consideration and diligent research. Start by assessing your individual needs and budget. Obtain quotes from multiple insurance providers and compare coverage options. Don’t be afraid to ask questions and seek clarification on any unclear points. Consider working with an independent insurance agent who can access policies from multiple carriers and provide unbiased advice. Remember, finding the right coverage is an investment in your financial security and peace of mind.

car insurance for emergency service workers uk

Do Emergency Service Workers Get Discounts on Car Insurance?

Yes, many insurance providers offer discounts specifically for emergency service workers. These discounts can vary depending on the company and the specific services provided. It’s essential to inquire about these discounts when comparing quotes.

What Coverage is Essential for Emergency Responders?

Essential coverage for emergency responders typically includes liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Additionally, consider adding personal injury protection and roadside assistance.

Does Using My Car for Emergencies Affect My Insurance?

Using your personal vehicle for emergency responses can potentially affect your insurance. It’s crucial to discuss this with your insurance provider to ensure adequate coverage and avoid potential complications in case of an accident.

John Smith, a senior insurance advisor at Safeguard Insurance, advises, “Always be transparent with your insurance company about how you use your vehicle. This will ensure you have the proper coverage in place.”

Emergency Service Worker Car Insurance Policy

Emergency Service Worker Car Insurance Policy

Conclusion

Finding the right car insurance for emergency service workers requires a proactive approach. By understanding your specific needs, researching available options, and comparing quotes, you can secure the best possible coverage at a competitive price. Remember, car insurance for emergency service workers is not a one-size-fits-all solution. car insurance for emergency service workers uk Take the time to find a policy that provides the protection and peace of mind you deserve.

FAQs

- What are the typical discounts available for emergency service workers?

- How does my driving record affect my insurance premiums?

- What is the difference between collision and comprehensive coverage?

- Should I consider an umbrella policy for additional liability protection?

- How often should I review my car insurance policy?

- What are the benefits of working with an independent insurance agent?

- Can I bundle my car insurance with other types of insurance for additional savings?

For assistance, please contact us via WhatsApp: +1(641)206-8880, or Email: [email protected]. Our customer service team is available 24/7.