A Career in Financial Services: Your Path to Success

A Career In Financial Services offers a diverse range of opportunities for ambitious individuals. From managing investments to advising clients, this dynamic field provides exciting challenges and rewarding prospects. This article will explore the various paths within financial services, helping you navigate your journey towards a fulfilling career.

Exploring the Landscape of Financial Services Careers

Diverse Career Paths in Financial Services

Diverse Career Paths in Financial Services

The financial services industry encompasses a broad spectrum of roles, catering to various skill sets and interests. Some popular career paths include:

- Investment Banking: Focuses on advising companies on mergers, acquisitions, and raising capital.

- Financial Advising: Provides personalized financial guidance to individuals and families on investments, retirement planning, and other financial matters.

- Wealth Management: Manages the assets of high-net-worth individuals and families.

- Insurance: Offers protection against financial risks, including life, health, and property insurance.

- Corporate Finance: Manages the financial activities of corporations, including budgeting, forecasting, and financial analysis.

Each of these paths presents unique challenges and rewards, requiring specific skills and qualifications. Understanding these nuances is crucial for making informed career decisions. You might be wondering how to get a career in financial services.

What Skills Do You Need for a Financial Services Career?

Key Skills for a Successful Financial Services Career

Key Skills for a Successful Financial Services Career

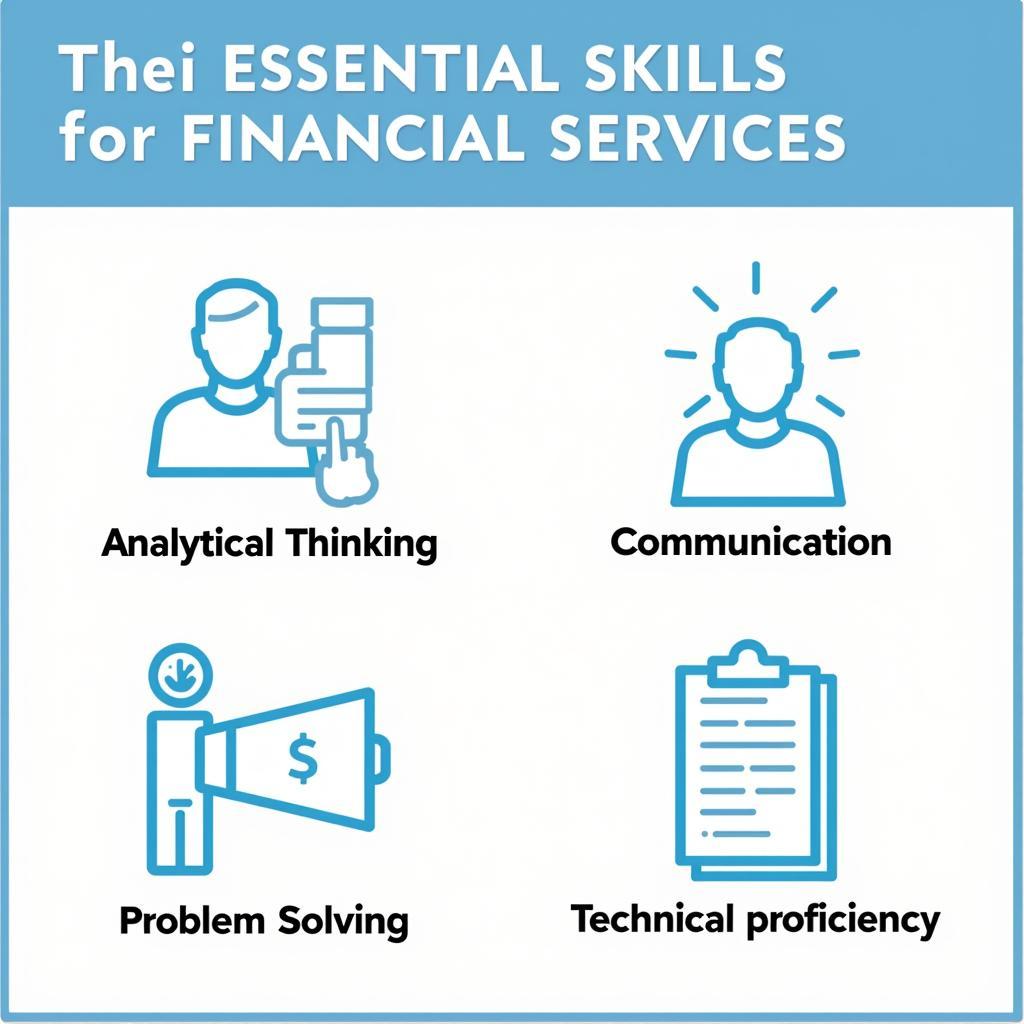

A successful career in financial services demands a combination of technical expertise and soft skills. Analytical skills are crucial for interpreting financial data and making sound investment decisions. Strong communication skills are essential for building client relationships and presenting complex information clearly and concisely. Problem-solving abilities are necessary for navigating challenging financial situations and developing innovative solutions. Technical proficiency in areas like financial modeling and data analysis is also highly valued. Furthermore, understanding what attracts you to a career in financial services is essential.

How to Prepare for a Career in Financial Services?

Gaining relevant education and experience is vital for breaking into the financial services industry. A bachelor’s degree in finance, economics, or a related field provides a solid foundation. Pursuing advanced degrees like an MBA or CFA can further enhance your credentials. Internships and entry-level positions offer valuable practical experience and networking opportunities. Additionally, staying updated on industry trends and regulations is essential for long-term success. Perhaps you’re considering how to prepare a career in financial services.

Building Your Network in Financial Services

Networking plays a significant role in career advancement within financial services. Attending industry events, joining professional organizations, and connecting with professionals on LinkedIn can open doors to new opportunities. Building strong relationships with mentors and peers can provide valuable insights and guidance throughout your career. This can lead to answers regarding why do you want a career in financial services.

Building a Strong Network in Financial Services

Building a Strong Network in Financial Services

Conclusion: Embark on Your Financial Services Journey

A career in financial services presents a rewarding path for those seeking intellectual stimulation, dynamic challenges, and the opportunity to make a significant impact. By developing the necessary skills, gaining relevant experience, and building a strong network, you can pave the way for a successful and fulfilling career in this exciting field. Thinking about how to build a career in financial services is a great first step.

FAQ

- What are the entry-level jobs in financial services? Entry-level roles include financial analyst, customer service representative, and teller positions.

- Is a master’s degree required for a financial services career? While not always mandatory, a master’s degree can provide a competitive edge, especially for certain roles.

- What are the highest-paying jobs in financial services? Investment bankers, portfolio managers, and hedge fund managers typically earn high salaries.

- How can I improve my chances of getting a job in financial services? Gaining relevant certifications, such as the CFA or CFP, can boost your credentials.

- What is the job outlook for financial services? The financial services industry is expected to experience continued growth in the coming years.

- What are the different types of financial services companies? These include banks, investment firms, insurance companies, and credit unions.

- What are the key challenges facing the financial services industry? These include regulatory changes, technological advancements, and cybersecurity threats.

Need assistance with your car service needs? Contact us via WhatsApp: +1(641)206-8880 or Email: [email protected]. Our 24/7 customer support team is ready to help.